The Renewable Energy Infrastructure trend refers to developing sufficient and reliable networks for efficient generation, transmission, distribution, and storage of energy generated by and from solar, wind and geothermal sources, hydropower, ocean power, biomass, and hydrogen from renewable processes. Applications range from electric vehicle (EV) and hydrogen charging stations to entire networks such as energy carrier grids.

Concerns about climate change are driving the shift from fossil-fuel based power generation and usage towards renewable power generation and consumption. Renewables account for an increasing proportion of the power mix, estimated to be 45-50% of generation by 2030 and 65-85% by 2050. Particularly in emerging markets, where energy needs and electrification are growing apace, demand for electricity is expected to more than double from 25,000 TWh in 2022 to between 52,000 and 71,000 TWh by 2050.

As homes, businesses, and industries steadily switch from fossil fuels to electricity-based systems for transportation, heating, industrial processes, and more, the rise of renewables and the associated increasing electrification are putting strain on the electric grid infrastructure. Its power generation, transmission, storage, and distribution systems need to be upgraded and expanded to accommodate growing demand. According to the IEA, governments and businesses must collaborate to ensure the world’s electricity grids are ready for the new global energy economy.

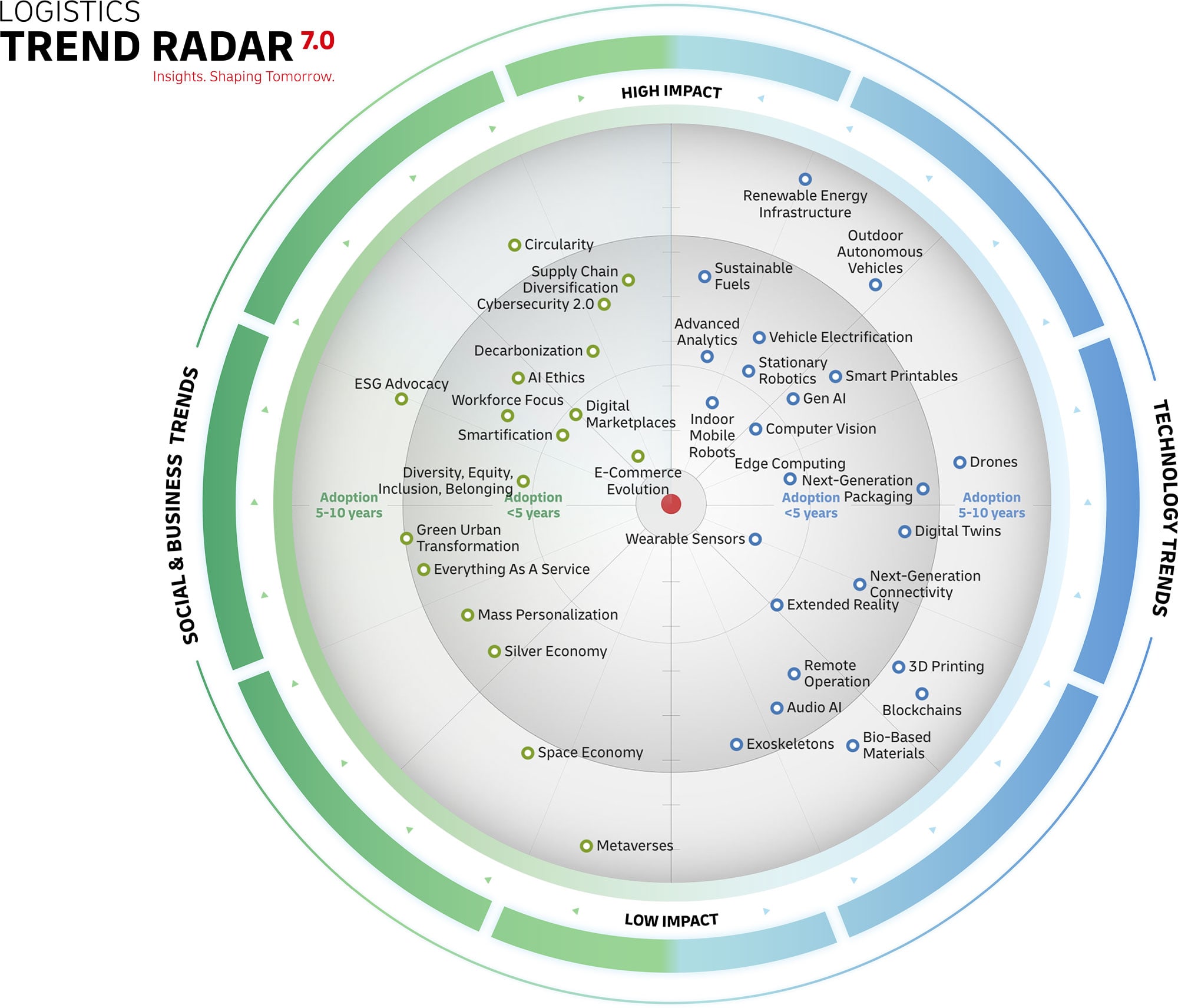

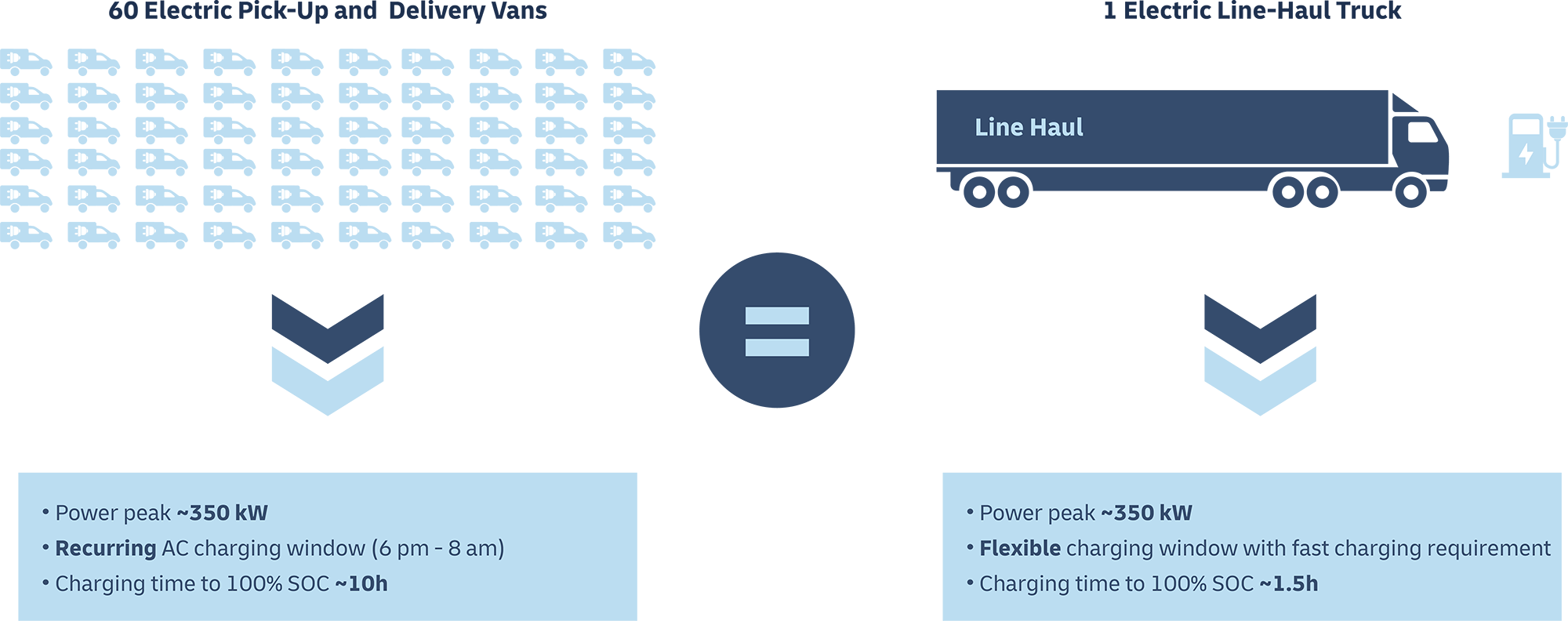

The logistics industry is strongly impacted by this trend and will also play a key role in setting up and maintaining the future renewable energy infrastructure. Logistics companies encounter significant challenges stemming from the escalating electricity demand brought about by vehicle electrification. This is particularly evident in the case of delivery truck and van fleets, necessitating robust charging infrastructure. Furthermore, the pursuit of carbon-neutral buildings adds to these challenges, with warehouses, distribution centers, and other supply chain facilities requiring energy-efficient technologies, practices, and the integration of onsite renewable power generation and storage.

While organizations focus on expanding their own onsite renewable energy infrastructure, they are also dependent on government initiatives and regulation to expand the overall infrastructure, including public charging points along transportation routes. In many countries, governments are already strengthening the renewable energy infrastructure through appropriate policies and measures, but implementation often takes several years.