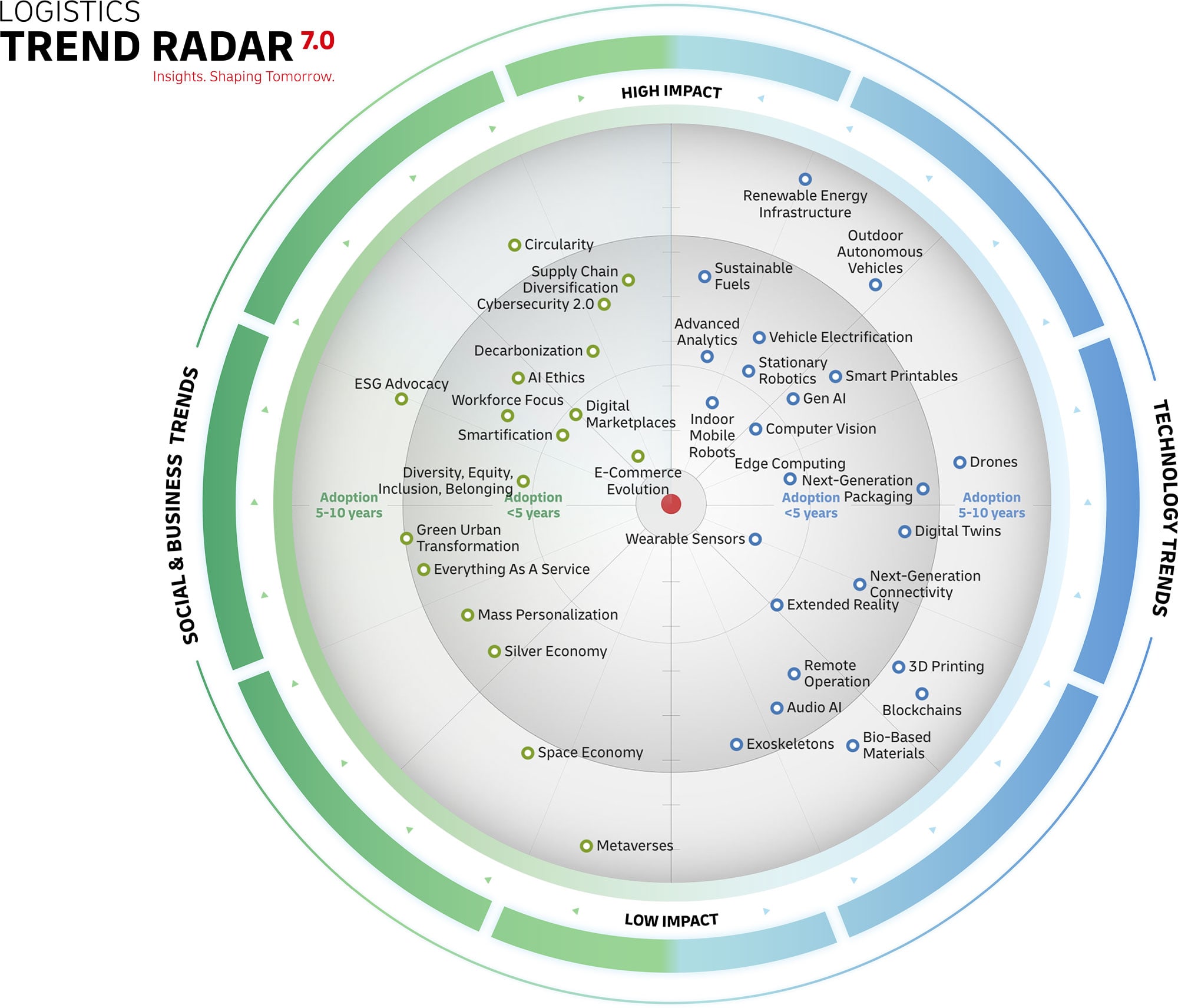

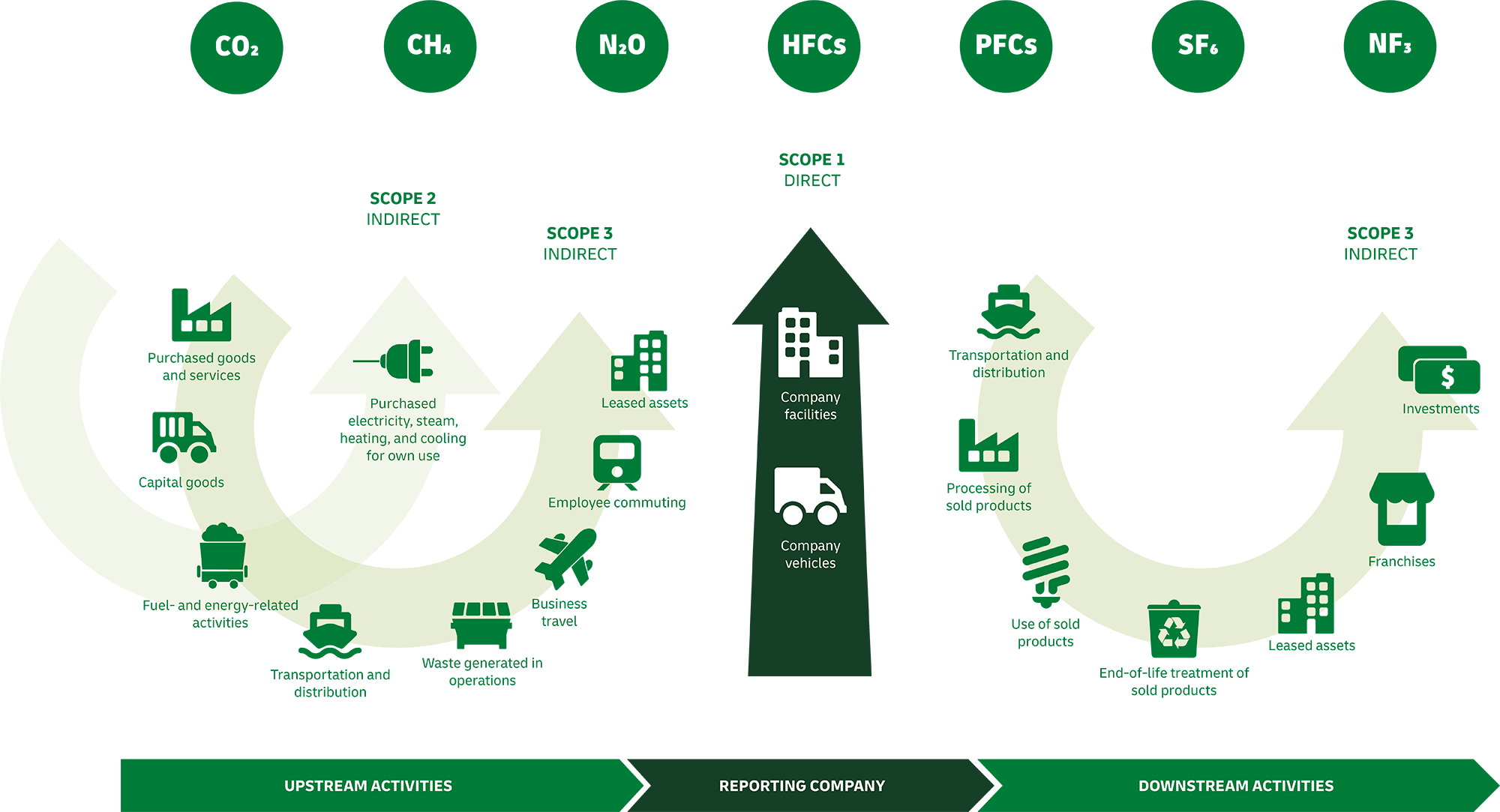

The trend of Decarbonization is the movement towards reducing the amount of carbon dioxide (CO2) and carbon dioxide equivalents (CO2e) in the atmosphere. Decarbonization involves burning less fuel for the same transportation operations and burning clean by increasing the share of clean, carbon-neutral transportation movements with the aim of reaching carbon neutrality and ultimately reaching carbon-negative operations.

With international concern about climate change and numerous new policy initiatives and regulatory obligations such as the European Council Green Deal and the European Union (EU) Sustainable Finance Disclosure Regulation (SFDR), the pressure is on organizations to decarbonize.

This is particularly true for logistics – supply chains generate around 60% of all carbon emissions globally, about 80-90% of a product’s emissions derive from its supply chain, and logistics accounts for ~10% of global greenhouse gas (GHG) emissions. Therefore, it is crucial for logistics organizations to decarbonize their operations and remain competitive.

The Decarbonization trend has high impact as practically all segments of the supply chain must change to eliminate CO2e emissions from operations. However, while many business-to-business (B2B) and business-to-consumer (B2C) organizations and other companies have set zero emissions targets and are taking important steps, more progress is needed to decarbonize the supply chain.

The development of this trend is expected to accelerate once regulations require disclosure of the carbon footprint of products and services, particularly as this will create an important point of comparison and competition between organizations.