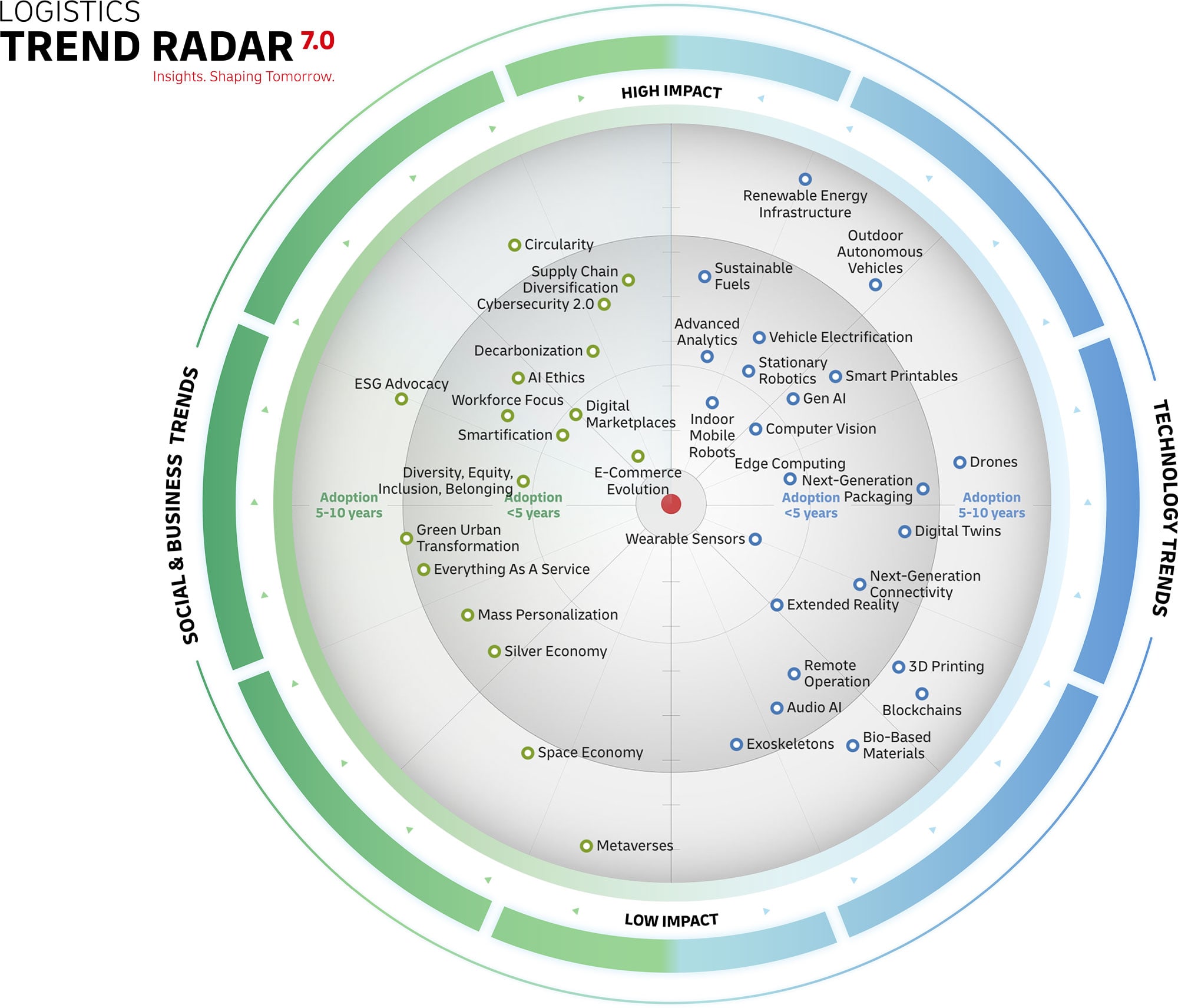

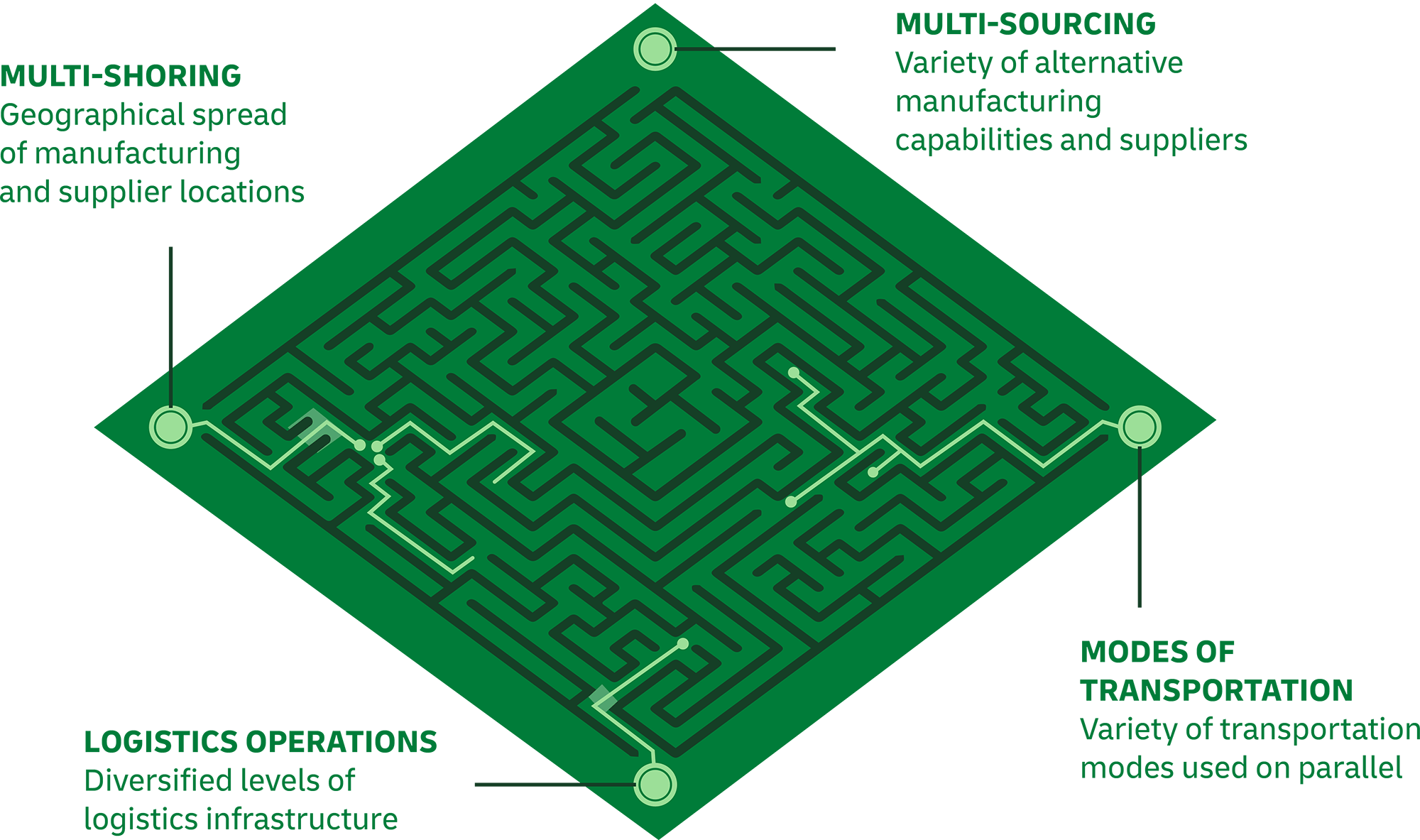

The trend of Supply Chain Diversification refers to the proactive strategy that involves embedding one or more of these four dimensions into the supply chain network: multi-shoring, multi-sourcing, adding modes of transport, and diversifying logistics operations.

It enables rapid adaption and reconfiguration of the supply chain to enhance customer centricity, resilience, sustainability, and agility which can improve competitive advantage.

Supply chain diversification is facilitated by technology and proactive relationship management along the entire supply chain enabling multi-stakeholder collaboration.

Since 1980, global trade has increased more than tenfold, reaching a record high of over US$ 32 trillion in 2022. DHL’s own analysis of global connectedness confirms that globalization hit a peak in 2022 and remained near that level in 2023.

Hidden behind these figures is a complex network of globally interconnected supply chains with an ecosystem of countless customers, suppliers, service providers, and partners. The recent accumulation of shockwaves caused by COVID-19, geopolitical crises, and natural disasters has led to considerable volatility, with disruption increasing by 183% since 2019 (33% in 2023 alone). The record highs also disguise the challenge of agility and resilience in supply chains, which prevent companies from responding effectively.

Understanding the complexities and dimensions of supply chain diversification and how they can be leveraged strategically beyond resilience can ultimately be a key to gaining a competitive advantage. Adopting a proactive approach to supply chain disruption is a strategic move for organizations, enabling them to increase sustainability, customer centricity, resilience, agility, and profitability in an uncertain business world.

In recent years, many companies have conducted strategic reviews of their supply chains to evaluate the need for diversification. For many organizations, these reviews have become a routine practice, and several have already implemented corresponding changes. These changes come in many forms, with the level of intensity depending on each company’s markets, strategies, objectives, and risk-taking appetite.

Given the strategic importance of resilient and agile supply chains for global trade as well as for sustainable long-term success of organizations, the impact of supply chain diversification is considered to be very significant.