The trend of Sustainable Fuels refers to energy sources that can be produced and consumed in a manner that minimizes negative environmental impacts; these fuels are used to power vehicles, machinery, and other equipment. Typically derived from renewable or low-carbon sources, sustainable fuels include conventional biofuels, such as ethanol and biodiesel, drop-in fuels such as hydrotreated vegetable oil (HVO), and more advanced synthetic fuels like electrofuels (e-fuels) and e-kerosene.

Demand for sustainable fuels is projected to grow as the world strives to meet decarbonization targets. They are highly applicable in the transportation industry – providing a much-needed alternative to fossil fuel usage – and could support faster decarbonization of existing fleets in the near term.

Sustainable fuels are projected to play a particularly important role in aviation and maritime shipping, while passenger cars, commercial vehicles, and other sectors will rely more on electrification.

Sustainable fuels are currently the most effective solution for decarbonizing supply chains at scale. During ‘production’ of sustainable fuels, CO2 is absorbed from the air. Only this previously absorbed CO2 is released during combustion of the fuel, making it a closed carbon cycle. However, as the fuels are produced from renewable sources, they do not contribute to the net increase of CO2 in the atmosphere.

Production capacities of sustainable fuel production are expected to grow substantially in the next few years as producers react to proposed mandates and growing demand. To date, over US$ 150 billion of sustainable fuel production capacity investments have been announced.

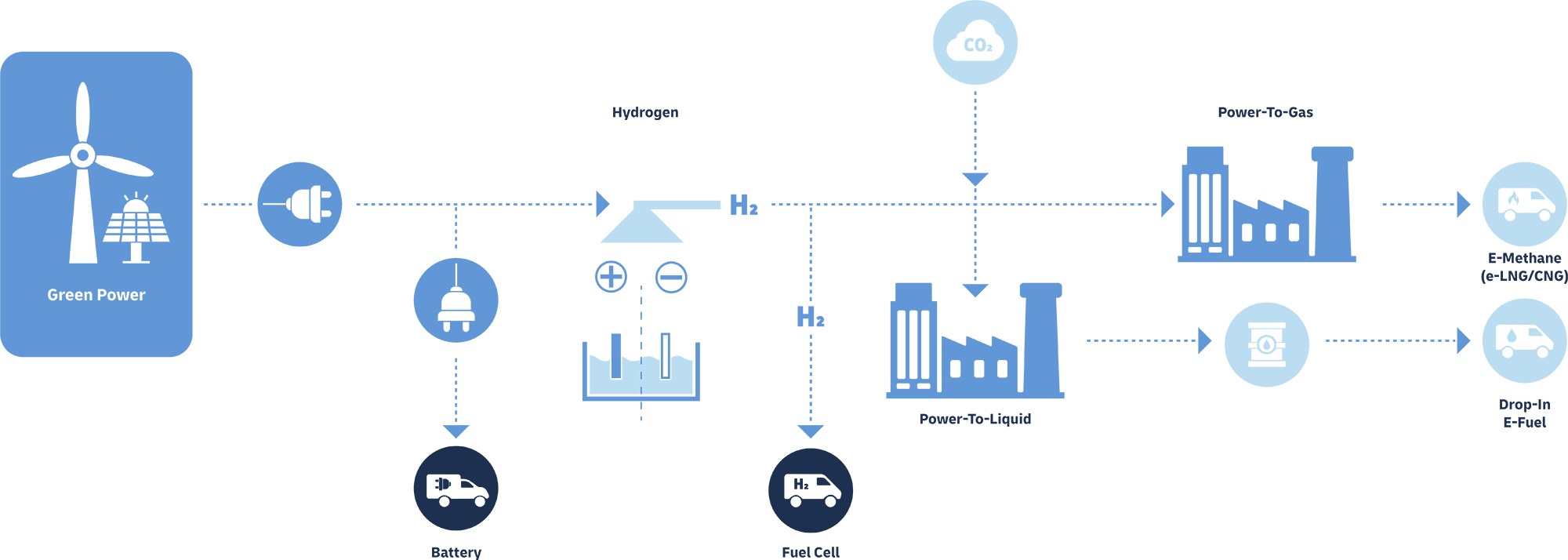

There are two types of sustainable fuels: biofuels and synthetic fuels. Their environmental impact varies depending on the respective source, the production process, and where they are used, such as in air, ocean, or road freight.

These fuels are so called drop-in fuels, which means they can be used directly in existing vehicles and infrastructure without any modifications. This contrasts with non-drop-in fuels, which require modifications in order to be used (such as liquified natural gas).

Biofuels use raw materials such as feedstock and agricultural waste that absorb carbon dioxide when being produced. When burned in an engine, they release the same amount of carbon dioxide as absorbed, making the process of combustion carbon neutral.

Synthetic fuels, or e-fuels, are made using captured carbon dioxide emissions and hydrogen. Here too, the carbon dioxide released when e-fuels are burned is equal to the amount taken out of the atmosphere to produce the fuel. E-fuels are considered carbon neutral if the hydrogen is produced with green electricity.

Synthetic fuels will not become abundant until enough green electricity is available. However, biofuels are available now and being scaled up rapidly across the air, ocean, and road freight sectors as production sites ramp up worldwide. Here at DHL, we believe now is the time to switch away from fossil fuels to help meet environmental goals and emissions requirements.