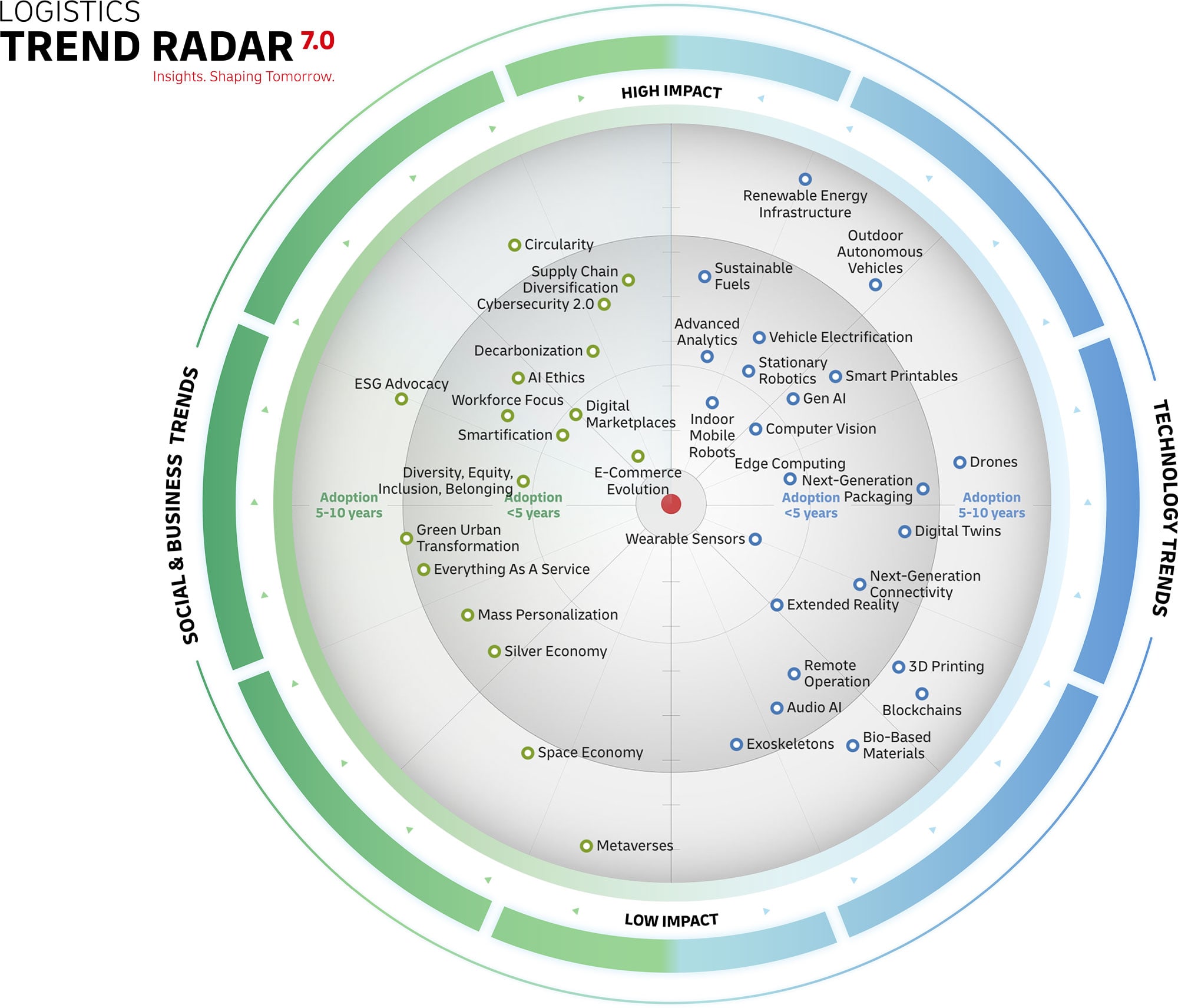

The trend of Digital Marketplaces incorporates digital brokerage platforms that match demand for products and services with available supply. These platforms give suppliers and customers access to a greater market while also offering them comprehensive transparency and additional services.

Customers value the ease of comparing shipping options and pricing and the access to labor in a digital logistics marketplace. Due to this growing demand, logistics providers and others have expanded their offerings in recent years and new, specialized marketplaces have emerged. For example, companies can access available logistics labor during peak seasons and compare shipping alternatives on various platforms. Many of these platforms are becoming more versatile thanks to growing numbers of participants, deeper data analysis, increasing transparency, and the creation of a better customer experience.

Digital marketplaces are having a significant impact on logistics, especially because of increasingly complex supply chain networks and countless options of logistics services and providers. These marketplaces take transparency to a welcomed new level. However, there is a shortage of scalable solutions in some areas; for example, in matching available workforces and logistics providers. This means it will take another two to three years before logistics marketplaces achieve market maturity at scale.