Industry impact deep-dive

Explore more: select the icons below to discover how Electrification & Connectivity affects industry sectors.

Consumers are increasingly choosing electric vehicles. As well as the environmental benefits, consumers want the advanced technologies, connectivity, and cost efficiency of electric vehicles. Meanwhile, semiconductors and software integration are enabling autonomous driving, dynamic vehicle management, and automated ordering of replacement tires and spare parts. And government policies are promoting the use of clean mobility. A mass-market tipping point is likely to be reached as battery and car prices fall and public charging infrastructure increases.

To dive deeper into this topic, we’ve invited experts to spark new ideas about electrification and connectivity – leaders like Dr. Lukas Mauler from Porsche Consulting, Björn Andersson at Volvo & Bernd Siffling at Mercedes-Benz, and Hank Zhao and Chunyi Yu from CATL. Watch their exclusive interviews for more insights. And tune into our EV TV showcase of now-and-future vehicle electrification.

Learn how Porsche Consulting aligns strategic vision with broader sustainability goals in the automotive industry. We discuss key technologies and innovations to drive the adoption of electric vehicles and enhance battery production efficiency. Watch now for Dr Lukas Mauler’s insights on significant partnerships and collaboration that advance the electrification agenda.

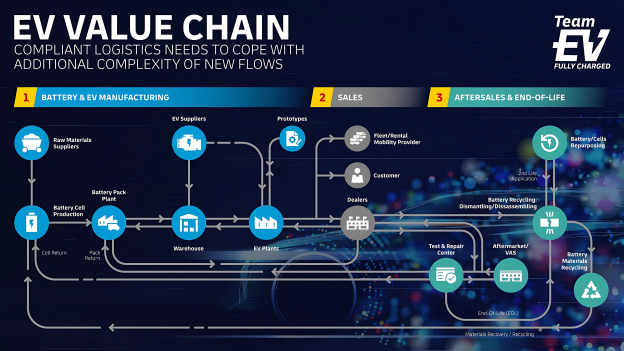

Electrification and connectivity are adding complexity to the supply chain, with new raw materials and new supplier integration in the automaker value chain. Along with new ecosystems, localised production of components is also a key trend. Additionally, there is more demand for specialised handling, storage, and transportation of new raw materials and goods. For example, batteries represent up to 40% of vehicle value and are classified as dangerous goods. In the value chain, it is essential to comply with policies and regulations as well as establishing new networks and vertical integration to maintain security and control.

Matching the new dynamics of electrification, automakers must adjust inventories and aftersales services. Sustainable solutions for handling and recycling used and damaged batteries are becoming crucial, and the value chain requires logistics partners capable of supporting new facilities such as gigafactories and charging station networks.

The future is electric. Watch DHL’s EV TV series to discover how the world of electric vehicles is evolving. We cover all aspects of EV technology, myths, and the logistics that supports the industry. Tune in to investigate electric vehicle range, batteries, benefits, and how this impacts the environment.

Our interview series ‘Logistics Talks’ provides an in-depth discussion with senior supply chain and logistics experts across various industries. Tune into this recap as Björn Andersson, Managing Director Middle East and Turkey at Volvo Trucks International and Bernd Siffling, Head of Parts Logistics Middle East & Egypt at Mercedes-Benz discuss pressing challenges in the region.

Explore more: select the icons below to discover how Electrification & Connectivity affects industry sectors.

Impact: High

Electrification: Clearly, there is a significant shift in demand from internal combustion engine parts to electric vehicle parts. This requires retooling production lines, developing new expertise, and establishing new supply chains for lithium, rare earth elements, and other raw materials. Now, more than ever before, there is a need to collaborate with new suppliers, particularly electronic component and battery specialists.

Connectivity: Component manufacturers are seeing a more complex, variable supply chain for advanced electronic components, sensors, and communication modules. Closer integration with original equipment manufacturers is needed to ensure compatibility of connected technologies and to maintain performance standards.

Impact: High

Electrification: New fleet management dynamics are developing. Companies are having to plan for charging infrastructure and the logistics of managing charging schedules. The components supply chain is shifting towards electric powertrains and batteries, but the adoption rate is slower than in the passenger vehicle subsector. New partnerships are emerging with battery manufacturers and technology providers.

Connectivity: More complex, diverse component supply chains are also developing, with sensors, cameras, communication modules, and more. In addition, there are new business models – visibility features and uptime management are becoming essential. To seize new commercial mobility opportunities, new partnerships are being developed between automakers and logistics providers.

Impact: Low

Electrification: Tire manufacturers are experiencing a slight change in demand patterns and logistics for tire replacement due to the higher torque of electric vehicles. Some supply chain adjustments are necessary, but these are not transformative. The development of tires specifically designed for electric vehicles requires a keener focus on lower rolling resistance and durability.

Connectivity: There is a moderate increase in complexity in the supply chain with the development of smart tires. These feature embedded sensors to monitor tire pressure and wear. Along with introducing new electric components into the supply chain, smart tires enable new business models. For example, by managing varying product lifecycles and holding different inventories, a tire manufacturer can exploit valuable new pay-per-use opportunities.

Impact: High

Electrification: Within the passenger vehicle supply chain, there are fewer mechanical parts and more electronic components. Specialized logistics solutions and regulatory compliance are required for vehicle batteries, as these are classified as dangerous goods. New partnerships are forming with battery manufacturers and technology providers. Companies are redefining the supply chain and creating a completely new ecosystem that supports new materials sourcing as well as dangerous goods handling.

Connectivity: Robust data management and cybersecurity are required for vehicle-generated data. Companies are integrating new technologies and service providers into the supply chain. In addition, sourcing and managing software updates and over-the-air service providers has added a new supply chain layer. And a more complex, diverse component supply chain is developing, containing sensors, cameras, communication modules, and more.

In this exclusive interview, industry leaders CATL share their insights on how the shift towards EVs and ESS (Energy Storage Solutions) has revolutionized sourcing raw materials, managing logistics, and production strategies. Listen to the unique challenges posed by EV batteries and ESS in terms of supply chain and logistical requirements, discover the future of battery recycling and end-of-life management, and learn more about the exciting innovations that lie ahead.

Explore real-world best practices & industry collaboration

Contact us to discuss what agile, electric, connected and sustainable supply chains could mean for your business.