FREQUENTLY ASKED QUESTIONS

Be up to speed and ready to ship in no time by understanding shipping regulations and trade terminology.

IMPORT GOODS INTO MALAYSIA

Under Malaysian Law stated in the Customs (Prohibition of Import) Order 2017, there are Absolute Prohibition and Conditional Prohibition. You may refer here for the full list. Below is a guide for items related to DHL Express:

Absolute Prohibition – The importation of the items into Malaysia is absolutely prohibited

- Any items sensitive to any religion, belief in Malaysia or may disrupt the peace and harmony of the country

- Pornographic Material items include but not limited to sex toys, sex dolls, illicit prints such as books, magazines, digital print and paintings etc

Conditional Prohibition – The importation of the items into Malaysia is allowed with an import license or in the manner provided by the Order

- Pharmaceutical Items such as Cosmetics, Vitamins, Supplements, Perfume, Skincare Products

- Cigarettes, Tobacco and any items containing Nicotine

- Wine, Liquor, Beer and Spirit as well as apparatus for home brewing

- Any items originating from Israel

- Any foodstuff and beverages for commercial purposes consumed by either human or animals

- Any form of Animal Skins

- Birds Nest

- Wood or any wooden products

- Telecommunication product

- Rubber Products such as tires

- Used/ Scrap electronic items including laptops and mobile phones

- Plants listed under the CITES Convention (Convention on International Trade in Endangered Species of Wild Fauna and Flora)

An importer may apply for a permit or license for importation directly from the Government Agencies or through an agent. The designated Government Agencies may be referred to the Customs (Prohibition of Import) Order 2017 Column 5 of each Schedule.

DHL Express does not perform any permit application on behalf of the importer. It is advisable for the permit approval to be obtained prior to shipment arrival into Malaysia.

Here are 3 reasons why your shipment is classified as rejected import:

Misrepresentation

- Declaring an item is one thing when it is really something else

- Generally this is done to beat duty at destination or to avoid import or export restrictions

Undervaluing

- This usually goes hand-in-hand with misrepresentation

- It involves saying something is worth less than it actually is

- The conscious undervaluing of an item is also done to beat duty at destination or to avoid import or export restrictions

Omission

- It means the shipper does not itemize or declare everything in the shipment

- If paperwork is presented for entry and an inspection of the goods reveals something has not been declared the shipper is, in effect, smuggling

REPAIR & RETURN

Do you need to send your shipment to another country for repair? If this is done properly, you can ensure a smooth transit. Repair and Return (R&R) is a clearance method that allows:

- Goods to be re-imported into the country free of duty (not VAT) after being repaired overseas at no cost to the importer

- Importers to bypass the import permit requirement for refurbished (or so-called second-hand) goods

When the goods are sent abroad, the sender is obliged to mark the waybill as an R&R shipment in order for the station and gateway to hold the shipment for further processing. Writing Repair and Return in the item description will do.

The shipper must also specifically identify the item that requires the R&R and provide the serial number of this item on the commercial invoice. If a shipment cannot be identified as the same item going out as coming in, customs may wish to do further inspections and delays can be expected. If your item does not have a serial number, having it engraved is a good way to allow for identification.

Yes, customers should inform DHL Express’s Customer Service and Gateway Customer Query before re-importation with SMK report.

Temporary Import is a facility for the temporary importation of goods without payment of customs duty/ tax with a security being given to the satisfaction of the Director General of Customs.

Meanwhile, Repair and Return stands to reason that duties would have been paid on the original import of the goods and therefore the same duties cannot be levied on the same goods twice.

When the goods are sent abroad, the importer is obliged to mark the waybill as a Repair and Return shipment in order for the station and gateway to hold the shipment for further processing. The shipper must also specifically identify the item that requires the Repair and Return and provide the serial number of the items on the commercial invoice.

The validity period for K2 Repair and Return is 3 months.

The importer is unable to seek extension if the K2 Repair and Return has expired. The importer may need to re-apply for the K2 Repair and Return.

The importers need to apply for temporary import process with the Customs if the shipment is imported in to Malaysia for repair and exported out after repair. Please refer to the temporary import question on the process.

Duty and sales tax will be imposed upon import if there is any miss in K2 Repair and Return clearance upon export.

The Repair and Return process flow can be referred to Gateway Clearance Work Instruction.

Yes, customers should inform DHL Express’s Customer Service and Customer Query (CQ) in respective gateway before re-importation together with Sistem Maklumat Kastam (SMK) export.

EXPORT GOODS OUT OF MALAYSIA

Exporters need to be aware of customs regulation at the importing country in order to avoid clearance delay or worse confiscation of the item resulting into violation of the destination country’s law.

Before exporting out of Malaysia, exporters must be aware and read through the Customs (Prohibition of Export) Order 2017 to ensure that any items that require permit for export are being provided to DHL Express upon pick up. Common items that are under Conditional Prohibition are but not limited to:

- Any items into Israel

- Birds Nest

- Rubber, Palm Oil, Plant and Animal Products

Export declaration requires invoice and waybill or any permit if shipment item is mentioned in the Customs (Prohibition of Export) Order 2017.

DHL will provide the declaration within 7 days after exportation. Under the Customs Act 1967 Sect 87A, a shipment moving via Air to outside of Malaysia is allowed to be declared within 7 days after exportation.

This however does not apply to shipments from Johor and also Prohibited Items.

EXPORT FOOD OUT OF MALAYSIA

Yes, you can. The consignee must obtain import license from the Singapore Food Agency (SFA) for commercial import.

Yes, you can. No import license is required for personal consumption that weigh less than 5kg.

Yes, you can. The exporter/importer should be registered in China customs. Chinese label registration is required. Paperwork for the registration are sanitary certificate from origin country, certificate of origin, sales contract, original label and Chinese translation.

Yes, you can. For personal purpose, the registration with China Customs can be exempted. But, the quantity should be reasonable for personal use. Meat, sea food and yolk products are not acceptable for personal shipments.

DHL Express does not accept any shipment that requires inspection by UK Customs at a Border Control Post (BCP). However, some food items and products of animal origin can be imported under UK Import license without the need for presentation at a BCP.

If you want more information on what DHL Express can or cannot accept, or are unclear about a certain commodity, do not hesitate to contact our Customer Service on DHL Express Facebook today!

Foodstuffs that is not commercially manufactured, commercially labelled or commercially packaged will be seized by Quarantine.

Yes, you can. Herbal or Nutritional Supplements must contain the full name/s of the product/s and an ingredients listing on the commercial invoice. Failure to comply may lead to clearance delays.

Yes, you can. Baby formula (Milk Powder) must have an Import Permit and Health Certificate to satisfy Australia Quarantine requirements. A declaration showing the full ingredients list is required for all food products.

All shipments into Australia containing foodstuffs must contain an accurate goods description of the said foodstuffs. Vague and ambiguous descriptions such as “snacks” OR “Food” are not acceptable. Failure to comply will result in regulatory (Quarantine) delays.

Yes, you can. Shippers are required to register with the FDA. Prior Notice is required for all food shipments with exception of homemade food to an individual with a value less than USD800. Foodstuffs must be commercially manufactured, commercially labelled or commercially packaged with list of ingredients and expired date.

Foodstuffs may also require the U.S. Department of Agriculture, Food & Drug inspection and/or import permit.

No, you cannot. Personal consumption mooncake with or without egg is prohibited from sending to the United Kingdom.

Yes, you can. Food and animal products may be imported to the United Kingdom if travelling under license. Shippers must self-assess legal requirements and provide veterinary & health certs, relevant licenses, or a statement confirming goods are not subject to any import restrictions.

Yes, you can send mooncake to Singapore for personal consumption. No import license is required for personal consumption and it has to be less than 5kg.

Yes, you can. However, the receiver must obtain an import license from the Singapore Food Agency (SFA).

Mooncakes are not allowed into Australia unless the importer holds the below valid documents:

• Valid import permit

• Health Certificate

• Manufacturer’s Declaration

Yes, you can. It will be subjected to an inspection by the Ministry for Primary Industries (MPI), so do expect delays.

Yes, you can only send mooncake without eggs. The importer should register in China customs. Chinese label registration is required. Paperwork for the registration are sanitary certificate from origin country, certificate of origin, sales contract, original label and Chinese translation.

Yes, you can only send mooncake without yolk. For personal purpose, the Chinese label registration can be exempted. But, the quantity should be reasonable for personal use. Meat, seafood and yolk products are not acceptable for personal effects.

Yes, you can. However, mooncake made in China is highly prohibited to be imported, with the exception of products containing non-meat and physical weight under 6KG approved by FDA.

Yes, you can. Shippers must clearly mention the type of commodity specifically on invoice. Mooncake with eggs or egg products, an import license is required. Exception on eggs: fully cooked or constitutes one of the ingredients of any compounded food).

Yes, you can. However, mooncake that contains certain animal commodity and or plant commodity is prohibited to be imported.

If you want more information on what DHL Express can or cannot accept, or are unclear about a certain commodity, do not hesitate to contact our Customer Service on DHL Express Facebook page today!

Examples of commodities the FDA consider to be food include:

- Dietary supplements and dietary ingredients

- Infant formula (baby food)

- Beverages including alcoholic beverages and bottled water

- Fruits and vegetables

- Fish and seafood

- Dairy products and shell eggs

- Raw agricultural commodities for use as food or components of food

- Canned and frozen foods

- Live food animals

- Bakery goods, snack foods, candy and chewing gum

- Animal feed and pet food

The following are exempt from Prior Notice requirements:

- Meat food products, poultry products and egg products that are subject to the exclusive jurisdiction of the U.S. Department of Agriculture (USDA) and comply with the USDA rules and regulations

- Food that was made by an individual in his/her personal residence and sent by that individual as a personal gift (i.e. for non-business reasons) to an individual in the United States. FDA recently expanded exemptions (or authorized enforcement discretion) to include all personal food shipments. These are shipments sent person to person for non-commercial purposes.

Examples include:

- Food in household goods, including military, civilian, governmental agency, and diplomatic transfers;

- Food purchased by a traveler and mailed or shipped to the traveler’s U.S. address by the traveler;

- Gifts purchased at a commercial establishment and shipped by the purchaser, not the commercial establishment;

- Food contained in diplomatic pouches.

Note: This does not include shipments sent from a retailer or distributor to an individual. Such shipments do require Prior Notice.

Samples of food for non-consumption valued below $200 have also been identified as exempt from PN requirements. This would include shipments clearly identified as samples destined for food manufacturers or testing labs, but would not include shipments to retailers or individuals.

The FDA has the sole authority to determine the scope of the covered commodities. Further details are available on the FDA Website.

All facilities that manufacture, process, pack, or hold food for human or animal consumption in the United States must register with the FDA.

Each registration must include:

- the name, address and phone number for the facility and its parent company (if applicable);

- the name, address and phone number of the owner operator or agent in charge;

- all trade names the facility uses;

- applicable food product categories; and

- a statement certifying that the information submitted is true and accurate and that the person is authorized to submit the registration.

- All non-US facilities must also designate a U.S. Agent who must live or maintain a place of business in the U.S. and be physically present in the U.S. for purposes of registration

DHL Express USA Inc can file Prior Notice for individual shipments (see Section 4 below), but does not offer registration services. Customers can register direct with the FDA at the FDA Website.

In addition to standard invoice requirements, the following elements must be included on the shipping invoice and be available at the time of pick up:

- Identification of each article of food, including the common or usual name or market name, the quantity described at the smallest package size, and the lot or code numbers or other identifier.

- In order to be able to submit a proper Prior Notice DHL requires English language description of each food item shipped. (The FDA product code, if known (available from the FDA Website, will speed up the process.)

- Complete name and address of the manufacturer or grower and their FDA registration number (if available)

- Country of production

- Complete name and address of shipper and their FDA registration number (if available)

- Complete name and address of the importer, purchaser or ultimate consignee and their FDA registration numbers (if available)

The “Required Information for FDA Prior Notice Submission” can be completed and included with the shipping documents to ensure all details necessary are available.

Note that a separate prior notice is required for each article of food when any of the above items varies or changes. This also includes changes in the size or kind of packaging or container.

DHL will require submission of a Prior Notice confirmation number or the required data elements to submit a Prior Notice application on the shipping documentation at the time of pick up.

The FDA also allows food importers to submit the Prior Notice application directly. Prior notice must be submitted electronically at the FDA Website

The “Required Information for FDA Prior Notice Submission” can be completed and included with the shipping documents to ensure all details necessary are available.

EXPORT DURIAN OUT OF MALAYSIA

Durian Express is an initiative by DHL Express Malaysia that aims to help Malaysia’s durian business owners meet surging demand for the popular fruit in key export markets.

With Durian Express, business owners have the flexibility of making shipments to their overseas warehouses, commercial entities like greengrocers and supermarkets, or residential and office addresses.

Our initiative aims to help durian business owners meet the overseas demand spike, which guarantees next-day delivery in less than 24 hours.

Durian Express is only available to DHL Express Malaysia’s approved account customers. Besides, Durian Express can export the king of fruits to Hong Kong and Singapore only.

Yes, DHL Express can accept durian and durian processed food with proper vacuum packing to Hong Kong and Singapore only for our account customers.

The shipper has to ensure that the shipment is with sufficient gel pack to maintain the required temperature during shipment transit.

With Durian Express, business owners have the flexibility of making shipments to their overseas warehouses, commercial entities like greengrocers and supermarkets, or residential and office addresses.

Bulk orders can also be made for large-volume orders that will give businesses the option of individual dispatch to separate locations.

Throughout the past 5 years, the harvest area for durian in Malaysia has been expanding, as durian is one of the most profitable fruits for farmers and exporters.

To export durians, you are required to provide a MAQIS Export Permit and a Conformity 3P Certificate (GPL) or Certificate of Conformity (CoC) from FAMA.

To register as an exporter with FAMA for Conformity 3P Certificate (GPL) or Certificate of Conformity (CoC) through www.e3p.fama.gov.my. Meanwhile, to register as an exporter with MAQIS for Export Permit through online epermit.dagangnet.com.

EXPORT COSMETICS OUT OF MALAYSIA

Yes, DHL Express can only ship perfume without alcohol.

Yes, we can. An MSDS document is required.

Yes, we can. However, DHL Express do not accept any liquid based contains alcohol to ship internationally. However, do send an email to MY_CS_DG@dhl.com for approval.

Yes, we can.

Yes, you can. Shipping cosmetics are subjected to customs duty and tax unless covered by De Minimis Value of Php 10,000.00.

Yes, you can. Shipping cosmetics are subjected to the approval from HSA. The receiver must provide the product license and the commercial invoice must state name of medicine/drug, brand name, reason for import, product composition, quantity per bottle and weight of each capsule.

Yes, you can. In order to ship cosmetics, a detailed description and end use of the cosmetic item required. The manufacturer’s full name, physical address and the product registration number is also required.

Yes, you can. However, cosmetics containing lead must be declared. Cosmetic products containing cannabis or cannabidiol (CBD) oil are prohibited.

Cosmetic products for personal use is a prohibited item to Indonesia regardless quantity, weight and value.

The importation of cosmetics by a business entity into Indonesia is restricted and a permit from the National Agency of Drug & Food Control (BPOM) is required and the consignee is required to apply for this permit. If the maximum value (FOB) / shipment is more than USD 1,500, the certificate of inspection from origin is required.

Yes, you can. In order to ship cosmetics in powder, gel or iquids form, MSDS may be required.

If you want more information on what DHL Express can or cannot accept, or are unclear about a certain commodity, do not hesitate to contact our Customer Service on DHL Express Facebook page today!

EXPORT MEDICINE OUT OF MALAYSIA

Yes, you can. In order to ship non-prescription medicine, you must have NOC (No Objection Certificate) from Drug Administration. Medicine with prescription sent to a company must have NOC from Drug Administration. Whereas prescribed medicine sent to personal name will require prescription matching receiver’s name from physicians for personal use only (max weight: 2kgs). The receiver may need to visit customs if the authority requires.

If you want more information on what DHL Express can or cannot accept, or are unclear about a certain commodity, do not hesitate to contact our Customer Service on DHL Express Facebook page today!

Yes, you can. The importation of personal medicine into Singapore must be accompanied with either one of these document:

a) Prescription issued by a Singaporean Resident Doctor or

b) An email approval from the Singapore Health and Safety Authority (HSA).

The shipper has to indicate on Waybill description as “HSA Approved Medicines” for importation using HSA approval. Shipment without proper supporting documents will risk shipment seizure and destroy by the Singaporean custom.

Medication without prescription is subject to approval from Health Science Authority and receiver must provide product license. Invoice must state name of medicine/drug, brand name, reason for import, product composition, quantity per bottle & weight of each capsule.

If you want more information on what DHL Express can or cannot accept, or are unclear about a certain commodity, do not hesitate to contact our Customer Service on DHL Express Facebook page today!

Yes, you can. The importation of personal medicine into Singapore must be accompanied with either one of these document:

a) Prescription issued by a Singaporean Resident Doctor or

b) An email approval from the Singapore Health and Safety Authority (HSA).

The shipper has to indicate on Waybill description as “HSA Approved Medicines” for importation using HSA approval. Shipment without proper supporting documents will risk shipment seizure and destroy by the Singaporean custom.

Medication without prescription is subject to approval from Health Science Authority and receiver must provide product license. Invoice must state name of medicine/drug, brand name, reason for import, product composition, quantity per bottle & weight of each capsule.

If you want more information on what DHL Express can or cannot accept, or are unclear about a certain commodity, do not hesitate to contact our Customer Service on DHL Express Facebook page today!

EXPORT ELECTRONICS OUT OF MALAYSIA

Yes, you can. Only 2 units of mobile phones are allowed per AWB. The battery has to be built-in.

Yes, you can. If your laptop has a removable battery, you may need to remove the battery and send the laptop only. If your laptop has a built-in batter, only 2 units of laptops are allowed per AWB.

If you want more information on what DHL Express can or cannot accept, or are unclear about a certain commodity, do not hesitate to contact our Customer Service on DHL Express Facebook page today!

STRATEGIC TRADE GOODS

In Malaysia there is a law on Export Control which is referred to as Strategic Trade Act 2010. Under the Act, there is a list of items (STA Items) which requires a permit from Ministry of International Trade and Industry (MITI) prior to exportation. These items may be military items or items which are considered of dual use and may be used in the act of violence and terrorism.

DHL Express will assist in declaring the STA items to the RMCD based on the instruction of the exporter. The exporter is responsible to provide DHL Express the permit issued by MITI in order for the items to be declared in the K2 form as STA shipment.

DHL Express will assist in declaring the STA items to the RMCD based on the instruction of the exporter. The exporter is responsible to provide DHL Express the permit issued by MITI in order for the items to be declared in the K2 form as STA shipment.

There will be penalties imposed by the RMCD if an STA item with a permit was not declared prior to uplift.

If there is no form of declaration by the exporter, MITI and RMCD have the rights to proceed with legal action towards the exporter for not complying.

INCOTERMS

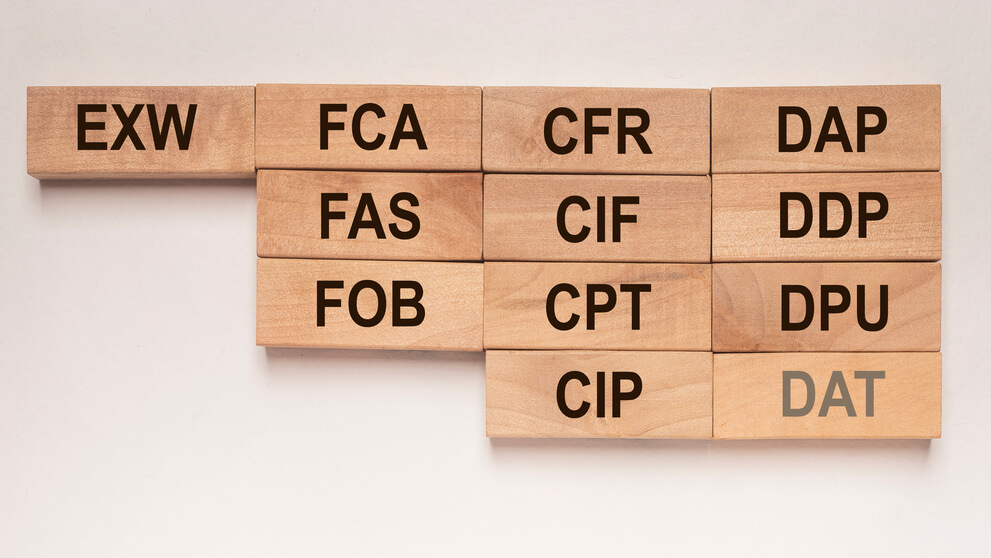

The Incoterms, or International Commercial Terms is a set of rules that outline the responsibilities and risks to be placed on the seller and receiver during an international trade process.

The diagram below will help you understand the responsibility between the seller and the buyer throughout the entire shipping process, from customs clearance and shipping insurance to exporting of courier services. Bear in mind that incoterms also has specific mode of transport that it covers and also Incoterms such as DDU is being replaced by a new term in compliance to INCOTERMS 2020.

Incoterms stated in the invoice is used for Customs Valuation Purposes. For importation into Malaysia, Cost Insurance and Freight (CIF) is being used.

Some customers may not have in depth knowledge of Incoterms or in certain situation the shipment is to be shipped by sea however due to urgency the mode of transportation is change at the last minute. FOB value is referred to by customs as the value agreed between buyer and seller as per item value stated in the invoice. This means that the value of Insurance and Freight has to be added in to determine the Customs Value.

There is a possibility of the above happening if the IATA TACT Rate value is higher than the stated freight value or the shipping cost stated is too low.

IATA TACT Rate is an annual shipping rates extracted from IATA TACT website to determine the shipping value based on the origin and weight of the shipment. This rate is agreed annually between Customs and the Express Companies in Malaysia in reference to the IATA TACT website. The rate table is updated at the back end of our DCE system and may only be shared to customers upon request.

FCA in incoterms is short for “Free Carrier”. It is the seller's responsible for export clearance and delivery of goods to the carrier at the named place of delivery.

Unless otherwise agreed upon, the seller is only responsible for loading the goods if the seller’s place of business is the named place of delivery.

DAP in Incoterms is short for "Delivered At Place". It states that the seller is responsible for arranging carriage and for delivering the goods, ready for unloading from the arriving means of transport, at the named place.

The seller assumes all risks involved up to unloading. Unloading is at the buyer’s risk and cost.

DDP is short for "Delivered Duty Paid". It states that the seller assumes all responsibilities and costs for delivering the goods to the named place of destination. The seller must pay both export and import formalities, fees, duties and taxes.

The buyer is free of any risk or cost until the goods are unloaded from the vehicle at the named place of destination, usually the buyer’s place of business.

EXW is short for "Ex Works".. It states that the seller is expected to have the goods ready for collection at the agreed place of delivery.

The buyer is accountable for all subsequent costs and risk, including all export procedures, starting with loading the goods onto a transport vehicle at the seller’s premises.

FOB is short for “Free on Board”. It states that the seller clears the goods for export and ensures they are delivered to and loaded onto the vessel for transport at the named port of departure.

The buyer takes over risk and costs, including import clearance and duties, as soon as the goods are loaded onto the transport vessel at the port of departure.

HS CODE

The Harmonized System (HS) code is a categorization system created, developed, and maintained by the World Customs Organization (WCO). Every commodity is tagged to an HS code, and the code assigned to it is internationally recognized in almost every country and is commonly used in customs to clear shipments.

Each HS code comprises of six digits. The first two digits identify the chapter of which the HS code falls under. There are a total of 21 chapters, each chapter provides a description to generalize the category. The next 4 digits comprise of the heading and sub-heading within the chapter.

ASEAN countries follow the ASEAN Harmonized Tariff Nomenclature (AHTN) – where the first six digits still take reference from the international HS codes, but there is an additional two digits at the end that further breaks down the sub-headings. Commodities shipped within ASEAN normally use the eight digit AHTN classification, but the 6 digit HS codes are also considered valid.

You can visit (http://tariff.customs.gov.my) and search for any of your commodity. When in doubt it is best to seek expert advice and let our Certified International Specialist classify your products.

DHL will refer to the invoice provided for HS Code classification by the shipper. If there is no classification done, DHL will use the Malaysian Customs Duties Order to classify the items in the shipment to the best of our knowledge. DHL will classify the shipments using a 10 digit HS Code based on the Customs Duties Order 2017.

The HS contributes to the harmonization of Customs and trade procedures, and the non-documentary trade data interchange in connection with such procedures, thus reducing the costs related to international trade.

HS Code is also extensively used by governments, international organizations and the private sector for many other purposes such as internal taxes, trade policies, monitoring of controlled goods, rules of origin, freight tariffs, transport statistics, price monitoring, quota controls, compilation of national accounts, and economic research and analysis. The HS is thus a universal economic language and code for goods, and an indispensable tool for international trade.

Each HS code structure comprises of six digits. The first two digits identify the chapter of which the HS code falls under. There are a total of 21 chapters, each chapter provides a description to generalize the category. The next 4 digits comprise of the heading and sub-heading within the chapter.

You can visit (http://tariff.customs.gov.my) and search for any of your commodity.

You can find the HS Code for your product with the Tariff Classification tool from JKDM HS Explorer or seek expert advice and let our Certified International Specialist classify your products for export.

Similarly, to move goods in and out of the US, you can use the US Census Bureau’s Schedule B search tool or the US International Trade Commission’s HTS search tool to find your HTS Code.

For the UK, you can use the Trade Tariff tool, provided you know the type of your product, the material used to make it, and its production method.

Incorrectly classifying a product can lead to overpayment/underpayment of duties, non-compliance penalties, shipment delays, failure to utilize free trade agreements or used in error, seizure of the products, or even a denial of import/export privileges. As the exporter of the products, you are responsible for correctly classifying them, and therefore you are liable.

When in doubt it is best to seek expert advice and let our Certified International Specialist classify your products. Read more about our customs services.

You can find the HS Code for your product with the Tariff Classification tool from JKDM HS Explorer or seek expert advice and let our Certified International Specialist classify your products for export.

Similarly, to move goods in and out of the US, you can use the US Census Bureau’s Schedule B search tool or the US International Trade Commission’s HTS search tool. For the UK, you can use the Trade Tariff tool, provided you know the type of your product, the material used to make it, and its production method.

Over 98 % of the merchandise in international trade is classified in terms of the HS. However, HS code can go beyond the WCO-prescribed six digits.

This is because countries are allowed to add more digits to the original six-digit code for further classification. These additional digits typically vary from country to country to categorize and define commodities at more detailed level without modifying or changing first six digits.

For example in United States, 10-digit codes are used where the first six digits are the WCO-provided HS code. The US code is called a Schedule B number for export goods and a Harmonised Tariff Schedule (HTS) code for import goods.

Similarly, in India, goods for export and import have an eight-digit code called an Indian Tariff Code (ITC). This system has two schedules – Schedule I for imports and Schedule II for exports.

Yes, HS Code is required on the commercial invoice and other shipping documents. Otherwise, you’ll risk the receiver paying the wrong tax and could possibly delay the shipment.

Tariff classifications can be open to interpretation, which can result in a shipment being misclassified. Regardless of the reason, misclassified shipments can have multiple adverse consequences including:

- Overpayment/Underpayment of duties

- Failure to utilize free trade agreements or used in error

- Lead fines, liquidation and other penalties

- Unexpected customs clearance delays

- Seizure of the products

- Denial of import/export privileges

HS codes are used to classify and define goods traded internationally to determine rate of duty, eligibility for exemptions, qualification for approved manufacturer/assembler tariff provisions and calculation of any other additional taxes (e.g. excise).

HS Code declaration is based on the commodity that is being shipped. DHL is required to ensure declaration of HS Code is referred to the invoice provided.

However, if there is no HS Code indicated in the invoice, DHL Express will declare a shipment HS Code to be best of their knowledge.

Any duties and tax incurred above RM1000, DHL will refer back to the customer before we proceed with clearance. As such if the approval has been provided by the customer, the importer will be liable to pay the duties and tax for clearance of the shipment.

If there is any short payment due to wrong HS Code during importation, customs have 7 years from the time of importation to seek the outstanding amount from the importer.

Any amendment after a shipment has been cleared has to be approved by the State Customs Director on a case by case basis.

It is important to engage with customs broker to determine if the HS Code on the commercial invoice is correct.

Customs classification is the numbered category in a country’s customs tariff schedule to which goods being imported or exported are determined to belong for the purpose of

- Imposing duties and taxes

- Recording into the country’s international trade statistics

Most countries classify goods in accordance with the harmonized commodity description and coding system, popularly known as harmonized system.

It also serves to ensure that the goods are not listed under prohibited import and export items of the Customs Order (Prohibition Regarding Imports) or (Prohibition Regarding Exports) or vice versa.

If a specific item has a customs ruling on its HS Code classification, the clearance of the shipment will always refer to the customs ruling. The customs ruling will provide ease of clearance with station customs officers. No Customs Officer can overrule the customs ruling issued by Customs HQ.

Shipments that go through cross border trading are required to be classified based on their product. The Harmonized System (HS) Code at a 6 digit level is developed and maintained by World Customs Organization (WCO).

The HS Code has been adopted and applicable by most of the country worldwide. It is then used to classify the products that are being imported or exported.

The HS Codes is then used to determine the duties and tax rates, control and restrictions as well as any rules of origin applicable to the country.

HTS CODE

The Harmonized Tariff Schedule (HTS) code is a unique 10-digit number that determines the tariff tax or duty incurred on items imported into the United States from other countries.

HTS codes are maintained by the United States International Trade Commission, but enforced by Customs and Border Protection (CBP) of the Department of Homeland Security.

HTS is also referred to as the Harmonized Tariff Schedule of the United States (HTSUS).

The HTS was enacted by Congress and brought into effect on January 1, 1989. The system is based on the HS, unlike the previous Tariff Schedules of the United States it replaced. While the USITC maintains and publishes the HTS, CBP is responsible for interpreting and enforcing the HTS.

HTS codes are product classification codes which are 10 digits long and broken down into five different sections.

The first six digits are an HS code, and the countries of import assign the remaining digits are additional subheadings used for further classification and establishing appropriate duty rates.

U.S. HTS codes are 10 digits and are administered by the U.S. International Trade Commission. Here’s the breakdown of an HTS code:

- Chapter: These first two digits identify the chapter in the HTS. The numbers are consistent internationally.

- Heading: These next two digits identify the heading within that chapter in the HTS. The numbers are consistent internationally.

- Subheading: These next two digits identify the subheading within that chapter. The numbers are consistent internationally.

- Subheading (Tariff rate lines): These next two digits establish duty rates. These numbers are specific to the United States.

- Statistical suffix: These last two digits are statistical suffixes that collect trade data. These numbers are specific to the United States.

The HTS code of an item tells you the duty (or tariff) on an imported good in the Rates of Duty column, based on the quantity in the Unit of Quantity column.

The rates of duty is divided into three different sub-columns:

- Column 1 (General): The rate of duty applied to imports from countries with which the United States maintains “normal trade relations.”

- Column 1 (Special): The rate of duty applied to special tariff treatment programs such as free trade agreements or the generalized system of preferences.

- Column 2: The rate of duty applied to imports from countries the United States does not maintain normal trade relations with, namely Cuba and North Korea.

There are three types of duty rates you will see in the HTS:

- Ad valorem: A percentage applied to the good’s customs value (e.g., 2.5%).

- Specific: A price per quantity of the good (e.g,. $0.05 per kilogram).

- Compound: An ad valorem and a specific price per quantity of the good (e.g., 2.5% + $0.05 per kilogram).

HTS codes can be located in individual HTS PDFs of each chapter, downloadable on the HTS website, or they can be looked up in the HTS search database.

HTS Codes is used to accurately identify traded products imported into the United States from other countries. These HTS numbers/codes are used by customs authorities to allocate the correct rate of duty and tax for each product into the United States.

The United States uses the HTS code which is a hierarchical numerical structure for describing goods for duty, quota, and statistical purposes.

The system is based upon the HS. The HTS is also sometimes referred to as the Harmonized Tariff Schedule of the United States (HTSUS).

HS and HTS Codes are widely used in the world of international trading. HTS and HS Codes were both developed by the World Customs Organization (WCO) and are used to classify and define internationally traded goods.

In order to import or export a product internationally, your traded goods must be assigned an HTS Code that corresponds with the Harmonized Tariff Schedule of the country of import.

The difference between an HS code and HTS code is the number of digits within the code. A code with six digits is a universal standard (HS Code) and a code with 7-10 digits (HTS Code) is often unique after the sixth digit and determined by individual countries of import.

Incorrectly classifying a product can lead to overpayment/underpayment of duties, non-compliance penalties, shipment delays, failure to utilize free trade agreements or used in error, seizure of the products, or even a denial of import/export privileges.

As the importer of the products, you are responsible for correctly classifying them, and therefore you are liable.

When in doubt it is best to seek expert advice and let our Certified International Specialist classify your products. Read more about our customs services.

A Schedule B number is a 10-digit code used in the U.S. to classify physical goods for export to another country. An HTS number is a 10-digit code used to classify physical goods imported into the U.S. from another country.

The US Census Bureau provides a free online Schedule B search tool that you can use to look up Schedule B Codes for your products. Check it out at: https://uscensus.prod.3ceonline.com/

Since establishing them in 1988, the World Customs Organization (WCO), governing body of customs administrations representing more than 180 countries updates the codes every five years to ensure they reflect changes and updates in technology and that they provide visibility into new product streams and emerging global issues.

HS 2022 will become effective on January 1, 2022, in its accepted seventh edition. The new HS2022 edition makes some major changes to the Harmonized System with a total of 351 sets of amendments covering a wide range of goods moving across borders.

Changes made in HS 2022 include new classifications for the:

- 3D printers

- Cell cultures and cell therapy

- Chemicals and materials specifically controlled under international conventions

- Dual-use goods that can be diverted for unauthorized uses such as detonators

- Electronic waste (e-waste)

- Flat panel display modules

- Fully electric heavy-duty vehicles

- Nicotine-based vaping products intended for inhalation without combustion

- Placebos and clinical trial kits for health and medical research

- Rapid diagnostic kits for health and medical research

- Smartphones

- Unmanned Aerial Vehicles (UAVs)

(Please refer to https://www.usitc.gov/publications/other/pub5171.pdf for complete list of modifications)

Importers trying to keep track of all these changes and updates, the breadth and depth of the HS presents a complex classification challenge, especially if the importer distributes hundreds or thousands of products to dozens of different countries.

Not only do importers have to keep track of changing HS codes for each product they sell, they also have to monitor HS changes for parts and materials of those products, as well as changes in the category subheadings and accompanying notes for each product.

Importers should review the changes to the HTSUS in conjunction with current classifications to determine what products may be affected by the modifications and ensure compliance when the changes take effect in early 2022.

The change in the HTSUS schedule may affect duty rates, customs compliance, Free Trade Agreement eligibility, tariffs, etc. These changes may even result in duty savings for importers.

No, these changes are part of World Customs Organization so tariff changes will be implemented worldwide by most WCO member countries.

SCHEDULE B

The Schedule B code is a U.S.-specific coding system administered by the International Trade Management Division of the U.S. Census Bureau to monitor U.S. exports. These codes take the same form as HS codes for the first six digits, but include four additional digits for a total of 10 numbers. These additional numbers help further identify and classify products.

The Schedule-B is built upon the first 6-digits of the HS code, and an additional 4-digits for statistical analysis. The ten-digit Schedule B can be broken down into four parts:

- Chapters – the first 2-digit numbers

- Headings – These build upon the Chapter codes by two, creating 4-digit numbers

- Subheadings – Builds on the Chapter and Headings codes with an additional two digits, creating the 6-digit number

- Country-specific Information - The U.S. requires additional information for exports including data on national tariff rates and commodity codes used for statistical analysis

Schedule B numbers are used for further product classification within the general category assigned by the HS number when exporting from the U.S.

You should know a product’s Schedule B :

- Determine which tariff rates (duty rates) may apply to the product or whether the product qualifies for any preferential tariff under the Free Trade Agreement

- Check for possible restrictions through the U.S. Export Administration

- Complete shipping documents such as the Shipper’s Export Declaration, letter of instructions, commercial invoices, and Certificates of Origin

- File Electronic Export Information (EEI) within the Automated Export System (AES) when the value of the product is greater than $2,500 or requires a license

The Schedule B which is administered by the United States Census Bureau is used to track the amount of trade goods that are being exported from the U.S.

The United States utilize the Schedule B for classification of physical goods exporting out of the United States. Schedule B is administered by the U.S. Census Bureau and just like the import HTS, the export Schedule B relies on the Global System Harmonized System issued by the WCO for its headings and subheadings.

It’s incredibly important to determine the proper HTS or Schedule B code for your imported and exported products. There can be consequences for misclassification of your products which can include overpayment/underpayment of duties, non-compliance penalties, shipment delays, failure to utilize free trade agreements or used in error, seizure of the products, or even a denial of import/export privileges. As the exporter of the products, you are responsible for correctly classifying them, and therefore you are liable.

When in doubt it is best to seek expert advice and let our Certified International Specialist classify your products. Read more about our customs services.

Using the wrong Schedule B code is likely to result in penalty fines when your product arrives at its destination because they are primarily used to determine the duty rates you may need to pay.

Should the wrong code be used, the tariff classification of the product will be different. Regardless of what you may initially pay, when the mistake is found by customs authorities, there will be additional monetary fines and penalties imposed. It may also increase the chances of your products getting stranded at port and creating delays likely to further impact your business.

SHIPPING DANGEROUS GOODS

DHL will refer to the invoice provided for HS Code classification by the shipper. If there is no classification done, DHL will use the Malaysian Customs Duties Order to classify the items in the shipment to the best of our knowledge. DHL will classify the shipments using a 10 digit HS Code based on the Customs Duties Order 2017.

The purpose of the MSDS is to:

- Provide information on the hazards of chemicals to protect users of chemical products

- Ensure safe operation and provide technical information for the formulation of safe operation procedures for hazardous chemicals

- Provide technical information helpful for emergency rescue and emergency handling of accidents

- Guide the safe production, safe circulation and safe use of chemicals

- It is an important basis and information source for chemical registration management

- It plays a very important role in the customs declaration, transportation, customs, air transportation, land transportation and other links of import and export

No. The MSDS serves as proof that your shipment is not classified as a dangerous good. Different countries may also have different requirements, so there is no hard and fast rule for the need of an MSDS. The bottom line is, in the event that your contents are an authorized dangerous good, they will have to adhere to proper packaging and transportation guidelines.

Kindly send MSDS to MY_CS_DG@dhl.com for further confirmation.

In most circumstances, MSDSs are readily obtainable online – especially if they are commercialized/readily available products in the market. However, in the event that the contents of your shipment are unique, you must create your own MSDS. If you manufactured the item, you should be able to produce a document indicating the breakdown of the contents in its physical state and the transportation requirements.

It is important to note that all MSDSs should be dated and have a validity period of 5 years.

It affects the overall transit time of your shipment. Most DG shipments have to be sent on cargo-only flights which are not as frequent as our daily flight schedules. On top of that, DG shipments are subject to more stringent security and customs inspections. We aim to deliver all your shipments in the quickest way possible – and your accurate declarations will play a significant part to speed up your delivery.

In most situations, DHL Express will hold back on processing your shipment until we receive the correct documentation. In the most extreme situations, we will reject the shipment and/or return it to you.

DHL Express employs a team of DG and MSDS experts that are able to efficiently help and advise you.

The same MSDS can only be used for recurring shipments if the hazardous material is exactly the same. For example, you can use the same MSDS for a lithium battery in many different types of products as long as the same lithium battery is being used. The MSDS will still need to be provided for every single shipment to certify that the hazardous material has not changed.

Dangerous goods (also known as hazardous material or hazmat) are any substances or materials that are capable of posing an unreasonable risk to health, safety, and property. Identifying dangerous goods is the first step to reduce the risks posed by the product with proper packaging, communication, handling, and stowage. HL is an established carrier of Dangerous Goods and as a leading transportation and logistics company, DHL Express adheres to the following regulations:

- IATA for all DHL Express air services

- ADR applicable within all countries that have adopted the ADR convention in their legislation

- Other applicable national legislation, depending on the origin, transit and destination of the shipment

Goods with these characteristics are considered dangerous (not exhaustive):

- Radioactive

- Flammable

- Explosive

- Corrosive

- Toxic

- Oxidizing

- Infectious

- Other regulated materials

Electronic equipment, perfumes and even food flavoring may be classified as Dangerous Goods. Some materials or chemicals may have characteristics that cause them to become harmful in specific circumstances.

The Material Safety Data Sheet or Safety Data Sheet from the manufacturer provides information to identify the content classification.

DHL Express requires pre-approval to ship Dangerous Goods to ensure that account holders are sufficiently trained, instructed and will prepare Dangerous Goods shipments according to the applicable regulations and DHL’s policies and procedures.

If you would like to ship via DHL Express, it is essential that you have a Dangerous Goods expert. With a wide experience of transporting all types of Dangerous Goods, DHL Express is perfectly placed to offer you professional advice.

DE MINIMIS

This is a Latin term and is a shortened version of the expression “de minimis non curat lex” meaning “the law does not care about very small matters.”

It is often considered more efficient to waive very small amounts of duties and taxes rather than collect them.

De Minimis value is a value below which goods can be shipped into a country before duties & taxes are assessed.

The legal term for this threshold is called the De Minimis Threshold (DMT) — derived from the full expression “de minimis non curat lex”. This roughly translates as “the law does not concern itself about very small matters”.

In the US, for instance, the DMT is US$800 (€702.70). This means that goods valued at US$800 or less can enter the US without incurring taxes.

De Minimis shipments are also known as Direct Release shipments.

De Minimis shipments are when imported shipments do not attract any duties and taxes due to its Cost, Insurance and Freight (CIF) value that is below RM500. Having said that, shipments must still be declared from customs using a simplified format with fewer data elements than formal clearance.

In Malaysia it is known as a K4 manifest which provides consolidated information of the shipments arriving into Malaysia.

However, any items under the Customs (Prohibition of Imports) Order 2017 must not be declared as a De Minimis shipment regardless of its value.

You may download the complete De Minimis value at https://shipping.dhl.com.my/deminimis .

LICENSE MANUFACTURING WAREHOUSE

Licensed Manufacturing Warehouse is established under the provision of section 65/65A of the Customs Act 1967. A LMW is granted to any person for warehousing and manufacturing approved products on the same premise. It is primarily intended to cater for export oriented industries.

In order to apply for a LMW license, the manufacturer shall fulfil the terms as stated below:

- Manufacturers who own a Manufacturing License under The Industrial Co-ordination Act 1975 (ICA) or have an exemption letter issued by the Malaysian Investment Development Authority (MIDA).

- Manufacturing that conforms to the manufacturing interpretation of Section 2 (1), the Customs Act 1967.

- Manufacturers that exporting more than 80% of the total value of finished goods for 12 months.

The manufacturer can apply by submitting at the nearest Customs Office which is close to the manufacturing premises, subject to conditions and procedures.

The documents required are:

- Covering letter

- Form JKED No 1

- Form A – Application for Licensed Manufacturing/ Warehouse under Section 65/65A of the Customs Act 1967

- Copy of Certificate of Fitness

- Copy of business license/ certificate issued by Local Authority

- Company registration documents (Form A and D; M&A, Form 9, Form 49, Form 44 Form 24)

- Copy of Manufacturing License issued under the ICA 1975

- Location plan, layout plan, elevation plan (certified by Registered Architect)

- Flow chart of the manufacturing process

- List of machineries and tools, raw material/ components, finished goods

- Input/ output ratio

- Rental of premises agreement letter

- A passport size photo and copy of identification card for each Director

- Other relevant documents

The activities allowed at a License Manufacturing Warehouse are:

- Value-added activity

- Re-manufacturing, repairing and servicing

- International Procurement Center (IPC)

- Regional Distribution Center (RDC)

A Manufacturing Bonded Warehouse is also known as a Licensed Manufacturing Warehouse (LMW) in Malaysia, as defined by section 65/65A of the Customs Act 1967. Any individual can apply for a LMW if they wish to warehouse and manufacture approved products on the same premises.

The same tax benefits are available to LMW as they are to FIZ, such as total tax exemption for raw materials, components, machinery, and equipment used directly in the production process.

Customs duty exemption is given to all raw materials and components used directly in the manufacturing process of approved produce from the initial stage of manufacturing until the finished product is finally packed ready for export.

The LMW holder must provide DHL Express with the below documents prior to importation

- LMW License

- LMW Exemption List and Approval

The approval is given by the Industrial Department of RMCD for importation of raw materials, packaging, machinery and tools as well as return shipments due to various reasons.

| Movement | Declaration Form | Remarks |

|---|---|---|

| Overseas Import into LMW | K1 | |

| Domestic into LMW | K9 | Declaration is not done by DHL Express Malaysia |

| LMW to PCA (Domestic) | K9 | Declaration is not done by DHL Express Malaysia |

| LMW to Bonded Warehouse | K2 | |

| FZ to LMW | K1 | |

| LMW to FZ | K2 | |

| LMW to Overseas | K2 |

It is the responsibility of the companies that are situated in the LMW to have a document control process with regards to shipment movement. DHL Express will only provide the copy of the Invoice, Waybill and the Declaration Form to the companies during shipment delivery.

TEMPORARY IMPORT & ATA CARNET

Temporary Import is a facility for the temporary importation of goods without payment of customs duty/tax with a security being given to the satisfaction of the Director General of Customs and with a view to subsequent re-exportation in consistent with the provision of Section 97 Customs Act 1967. Temporary Import is stipulated with specific conditions set by RMCD.

Goods are allowed to use the Temporary Import facility with the following purposes:

- Investigation and demonstration

- Exhibitions, performances such as drama, music and circus

- My theme, sport, meeting, conference or similar event

- Evaluation and testing

- To be fixed

The conditions to use the Temporary Import Facilities are as follows:

- Goods cannot be sold or exchanged.

- The same n goods must be re -exported to the country of origin before expiration.

- License / permit must be submitted for goods subject to the Customs (Prohibition on Imports) Order 2017 / Customs (Prohibition on Exports) Order 2017.

- Goods cannot be rented, sold, transferred or destroyed without the permission of the Director of State Customs.

The procedure is as follows:

1. The importer or appointed representative must submit the application form in writing to the Office of the Director of State Customs where the goods will be imported together with supporting documents such as:

- Invoice

- Packing list

- Bill of Lading/Airway Bill

- Authentication Certificate by the end user

- For international level exhibitions, a letter of approval by the Ministry of International Trade and Industry (MITI), exhibition schedule and confirmation letter from the organizer must be attached.

- License/ permit for goods subject to the Customs (Prohibition on Imports) Order 2017/ Customs (Prohibition on Exports) Order 2017

2. Physical inspection will be done by Customs for verification of goods.

The acceptable duration is 3months from the date of import. However, any extension (up to 12 months) needs to be applied prior to the deadline.

If any disposal or sale is done in the country, consent must be applied through RMCD.

In the event the items are not returned back within the approved period, the supposed duties and taxes must be paid at the importing station.

For items to be temporarily imported into Malaysia, the process must be initiated prior to importation. Failure to obtain the proper approval before doing so, will risk importers having to pay the duties and taxes for the importation.

The exhibitors may opt to apply for temporary export approval from the customs without the payment of customs duty/ tax when it arrives back into Malaysia. Exhibitors may also option for an ATA Carnet which allows a shipment to move from one country to another tax and duty free.

- Bank Guarantee Letter

- Temporary Import Approval from Customs

- Commercial Invoice

- Air Waybill

Temporary export is a facility provided to an eligible exporter to export goods for repair, goods for propaganda, research, demonstration purposes and will re-import by claiming import duty/sales tax exemption under the Customs Duty Order ( Exemptions) 2017 and the Sales Tax (Persons Exempt From Payment of Tax) Order 2018 with certain conditions.

Exporters who wish to export goods for repair will get an exemption under item 37 of the Customs Duty (Exemption) Order 2017 and item 36 of the Sales Tax (Persons Exempt From Payment of Tax) Order 2018.

Exporters who carry out propaganda, research and demonstration activities abroad will be exempted under item 39 of the Customs Duty (Exemption) Order 2017..

Exporters who have imported goods and duties/taxes have been paid, temporarily export the goods with the written approval of the Director General of Customs and then re -import the same goods under item 83 of the Customs Duties (Exemption) Order 2017 and item 37 of the Sales Tax (Persons Who Exempt From Payment Of Tax) 2018.

The applicant must submit an application in writing with certain supporting documents to the Director of State Customs where the goods are to be exported for approval by the Director of State Customs on behalf of the Director General of Customs for an exemption claim.

The supporting documents required are:

- Agent Appointment Letter

- Goods Invoice

- Pictures/ Catalogs

- Complete item description (Item Name/Model/Brand and measurements etc.)

- Other related documents:

- Propaganda/Demonstration (Letter from the organizer & Schedule of propaganda/demonstration)

- Research (Confirmation letter from research body/research institution abroad)

- Repair (Confirmation from the repair party in the form of a repair report during re -import)

If physical examination is not performed and the goods continue to be exported, the temporary export will be converted to normal export and is not eligible to claim any exemption.

Customs will not entertain any application if there is a claim from the company at a later date.

ATA Carnet is an internationally recognized customs document which allows a shipment to move from one country to another tax and duty free. These shipments must return back to its origin country within 1 year of travelling. Items shipped may be Commercial Samples, Professional Equipment for Movies and Events or Goods for Fair and Exhibitions.

Items that are allowed to be used are:

- Commercial Sample

- Professional Equipment (Trading Equipment)

- Items for exhibition use

- Items that can be damaged or disposable

- Goods that have been sold or offered for sale

- Gems

- Goods for the purpose of reprocessing or repair

- Vehicles

- Postal traffic

The terms of using the ATA Carnet documents are:

- Goods cannot be sold or exchanged

- The same goods must be re -exported to the country of origin before expiration

- Licenses / permits must be submitted for goods subject to the Customs (Prohibition on Imports) Order 2017 / Customs (Prohibition on Exports) Order 2017

Temporary Import and Export is applicable from one country to one country. Whereas for ATA Carnet the goods may be travelling from various countries entering and exiting during the duration of the Carnet. Think Formula One Race Season, Concert Tours, Documentary Filming.

Temporary importation/export using ATA Carnet documents will be processed at the Malaysian exit/entry point. If the goods are taken out through a different station when the goods are brought in, the importer must first inform the original station and vice versa.

The Carnet will be traveling together with the shipment. Upon entering a country, the customs officer will stamp on the counterfoil and remove a voucher from the set. The same process will need to be done for the goods exiting the country.

The shipment will require a physical inspection by customs.

Once inspection is done, the ATA Carnet counterfoil and remaining voucher (certificate sets) will be attached back to the shipment.

The temporary import period using the allowed ATA Carnet document is limited to 3 months from the date it is imported.

The application must be submitted to the Director of State Customs before the original approval period expires.

Yes, it is different in every Gateway.

Applications for ATA Carnet documents for export purposes can be made through the Malaysian International Chamber of Commerce and Industry (MICCI) at the following address:

Executive director

International Chamber of Commerce and Industry

C-8-8, Level 8, Block C, Plaz a Mont Kiara

2 Jalan 1/70C, Mont Kiara

50480 Kuala Lumpur

Tel: (03) 6201-7708

Fax: (03) 6201-770

Website: www.micci.com

Email: ramli@micci.com/adilah@micci.com

FREE ZONE, FREE COMMERCIAL ZONE & FREE INDUSTRIAL ZONE

According to the Free Zone Act 1990, “Free Zone” means any part of Malaysia declared to a Free Commercial Zone or a Free Industrial Zone.

A Free Commercial Zone is a Free Zone is designated area to perform commercial activities that include trading (excluding retail trade), breaking bulk, grading, repacking, relabeling and transit.

A Free Industrial Zone is a Free Zone that is a gazette area meant for manufacturing activities.

Payment of duties and taxes for goods brought into or placed in the Free Zones are not required. However, a declaration of entrance and exit must be performed by the clearance agents.

The documents required are as follows:

- Complete Set of Invoice

- Waybill Number

- Any related exemption if applicable

| Movement | Declaration Form | Remarks |

|---|---|---|

| Overseas Import into FZ | K8 | |

| Domestic FZ to FZ | K8 | Declaration is not done by DHL Express Malaysia |

| PCA to FZ | K2 | |

| FZ to PCA | K1 | |

| FZ to Bonded Warehouse | K8 | |

| FZ to LMW | K1 | |

| LMW to FZ | K2 | |

| FZ to Overseas | K8 |

It is the responsibility of the companies that are situated in the Free Zones to have a document control process with regards to shipment movement. DHL Express will only provide the copy of the Invoice, Waybill and the Declaration Form to the companies during shipment delivery.

SHIPPING DOCUMENTS / PAPERWORK

When it comes to shipping internationally, a commercial invoice is one of the most important documents. It provides key information for customs to clear your goods. That's why it's important to fill it in correctly with the right information.

It's one of the first documents that must be prepared by an exporter. It is the form that would classify the contents or merchandise in order that customs would properly receive and clear the shipment, as well, to ensure that the taxes and duties would have been appropriately assessed before the continuation of the shipment.

- State the true value of the shipment.

- Use the correct HS Code to classify your goods.

- Make sure that the air waybill (AWB) is attached to and matches the amount on the invoice.

- Any lines with same item description can be combined as one line item.

- Incoterms must also be checked and reflect the invoice provided for the shipment.

This involves the preparation and submission of all documents required to facilitate export or import into the country while representing the customers during customs examination, assessment, payment of duty and the delivering of shipments from customs after a successful clearance.

- The amount of any deduction from the price cannot be ascertained

- There is insufficient reliable information about any matter which must be taken into account

- For the circumstance in which a Customs Officer may determine, that he or she is unable to apply a particular valuation method because the Officer is not satisfied that there is sufficient reliable information

The documentations needed from a consignee for a smooth custom clearance of your shipment are:

- Material Safety Data Sheet (MSDS) - To check 100% details of composition that are requested by the pharmacy/ health department

- Local Purchase Order (LPO) - To check regarding the Government contract company

- Exemption - SST Exemption, LMW, RTO (required K2 form), RNR (required K2 form), MRO, Royal/ Agong

- Proof of Payment (POP) - To check payment of item that will be tally with the declaration and invoice

Customs need to clarify whether the declaration is correct and tally with the exemption issued by Customs.

Customers will need to confirm DHL Express Malaysia which port the shipment is at and when the vessel arrived in Malaysia. If the shipment declared as K8 , hence no additional paperwork is required.

K8 customs form is the customs declaration form gazette by the government for the movement of goods between bonded areas.

EXPORT & IMPORT PERMIT/LICENSE MALAYSIA

As an internationally recognized and accepted certification provider, SIRIM offers cost-effective third-party certification on the quality, safety and reliability of your products. By earning the certification marks, your products are shown to consistently manufacture with specific standards that boost customers’ confidence.

An individual can apply for a special approval from SIRIM which is a one-time approval permit and limited to a maximum of 3 products at once for personal usage.

For commercial purpose, you need to apply for the SIRIM Type Approval which may be reused a few times to import the shipments (depending on the AP [Approved Permit] given by customs).

You can apply the e-permit directly from SIRIM website.

Application forms can be downloaded from Malaysian Investment Development Authority (MIDA)’s website or obtained from the Business Information Center in MIDA or the nearest MIDA office.

Shipment with duties and taxes above MYR 500 or requires exemption confirmation.

Under the Sales Tax Act 2018, sales tax is charged and levied on imported and locally manufactured goods either at the time of importation or at the time the goods are sold or otherwise disposed of by the registered manufacturer.

However, sales tax is not charged on goods and manufacturing activities exempted by Minister of Finance under Sales Tax (Goods Exempted from Tax) Order 2018 and Sales Tax (Person Exempted From Payment of Tax) Order 2018.

All goods are subjected to sales tax except goods exempted under Sales Tax (Goods Exempted from Tax) Order 2018 (e.g. live animals, unprocessed food, vegetables, medicines, machinery, chemicals).

Certificates of exemption are granted to applicants generated through MySST system. The exemption from payment of sales tax on such persons and goods will take effect when, in respect of imported goods, at the time when the said certificate/ certificate number is produced to the proper officer of Customs and in respect of locally manufactured goods, at the time when the said certificate/ certificate number is produced to the registered manufacturer.

Exemptions should be applied by customer before item’s arrival.

Wood or any wooden products falls under Conditional Prohibition and which the importation of the items in Malaysia is allowed with an import license or in the manner provided by the Order.

Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) is an international agreement between government with aim to ensure that international trade in specimens of wild animals and plants does not threaten their survival.

CITES works by subjecting international trade in specimens of selected species to certain controls. Any importation or exportation of any items which falls under CITES list must be accompanied with an import/ export license.

Phytosanitary certification is used to attest that consignments meet phytosanitary (regarding plants) import requirements and is undertaken by an NPPO (National Plant Protection Organization). A phytosanitary certificate for export or for re-export can be issued only by a public officer who is technically qualified and duly authorized by an NPPO.

A phytosanitary certificate for export is usually issued by NPPO of the country where the plants, plant products or regulated articles were grown or processed. Specifically, this certificate is provided to shipment which is usually foodstuff and agricultural products such as birds nest, durian and others. A shipment with this certificate means that it has gone an inspection by the Agriculture department that it is free from any spread of fungus and infection.

Form D is a Certification of Origin (CoO) which is a document that verifies the origin of the content (origin) of a product. The exporters determine their own certificates of origin in order to enjoy the preferential tariff treatment.

The CoO is issued by the authority appointed by the Member States of the ATIGA for exporters or producers who have complied with the rules of origin (RoO). It shall be submitted to the customs authorities in the country of importation for the purpose of claiming the preferential tariff treatment. Each CoO can only be used for one importation.

Form D and Form E is not an exemption but a facilitation given to utilize any Free Trade Agreement (FTA). These forms are used to verify the Country of Origin of the item shipped and whether the importer can enjoy preferential tariff rates as prescribed in the FTA.

Local Purchase Order is issued to a registered person/ importer appointed by the Federal or State Department for the use of and supplied to the Federal or State Department. This LPO will exempt the importer from payment of duties and tax.

Drop shipment is usually when a shipment is having a different delivery address than the actual importer.

A permit is required when applying to certain types of goods listed under the prohibition of import or export list.

An import License is required for certain types of goods listed under the prohibition of import or export list. This is to ensure that only importers who have registered with the related authorities are the ones allowed to import the goods.

No, DHL Express does not provide any Import License. DHL Express also does not perform any permit application on behalf of the importer. It is advisable for the permit approval to be obtained prior to shipment arrival into Malaysia.

WAREHOUSING

Warehousing is the act of storing goods that will be sold or distributed later.

Warehousing comes in many shapes and sizes:

- Private Warehouse - privately owned by wholesalers, distributors, or manufacturers.

- Public Warehouse - owned by governmental bodies and made available to private sector companies as compared to different types of warehouses.

- Bonded Warehouse - can store imported goods before customs duties are required to be paid on them.

- Co-Operative Warehouse - owned by a co-operative where private firms can rent space for storage.

- Distribution Center - a storage space that is usually built with specific requirements in mind.

- Smart Warehouse - storage, fulfillment process, and management are automated with AI.

- Consolidated Warehouse - takes small shipments from different suppliers and groups them together into larger shipments before distributing them to buyers.

- 3PL Warehouse - A third-party logistics warehouse, or 3PL for short, is an outsourced business that takes care of a company's supply chain and logistics operations.

A warehouse management system (WMS) is a software solution that offers visibility into a business' entire inventory and manages supply chain fulfillment operations from the distribution center to the store shelf.