- DHL Export Barometer 2020 records Australian export businesses’ lowest confidence level in the study’s 18-year history

- However, majority of exporters predict business revenue to return by end of 2021

- Investment in e-commerce growth strategies reflected in export revenue growth

- New Zealand and the North America region hold ground as top export destinations

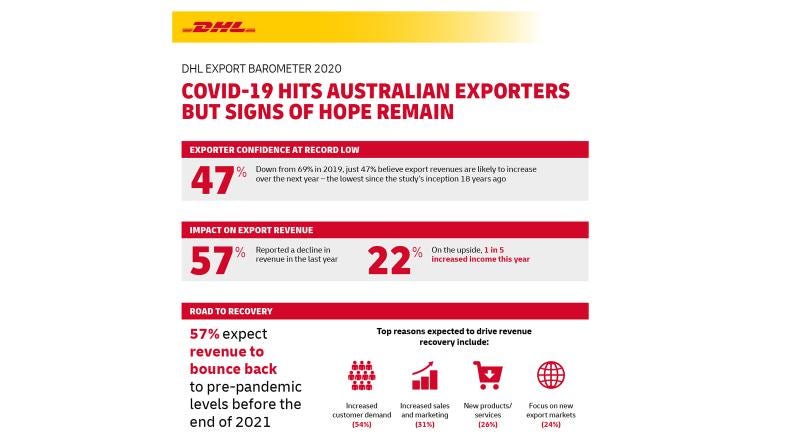

The findings of the DHL Export Barometer 2020, released today, reveal just 47% of Australian exporters are confident that the coming year will bring a likely increase in export revenue. This year’s figure marks the lowest confidence level since records began in 2003, down from 69% in 2019 and lower than the 48% recorded in 2011 following the global financial crisis.

In terms of actual revenue recorded in the last 12 months, 57% of exporters reported a decline, with 24% of those declaring a significant drop in revenue. Positively though, 1 in 5 (22%) export businesses increased revenue during the same period, and of this group 7% saw a significant increase in revenue.

“Although the challenges of this year has had a significant impact on overall exporter confidence, Australian export businesses have once again displayed their ability to pivot strategies to maintain and in some cases even increase export orders and revenue. This resilience is further reflected in the portion of exporters predicting business revenue to stabilise within the foreseeable future,” said Gary Edstein, CEO and Senior Vice President, DHL Express Oceania.

Exporters confident in business recovery by end of 2021

Despite drops in export orders and overall confidence this year, 57% of Australian exporters are projecting an expected return of revenue to pre-pandemic levels before the end of 2021.

Of the reasons likely to drive revenue recovery, more than half (54%) of exporters predict increased demand from new or existing customers will boost export orders, while increased sales and marketing (31%), new products or services (26%), focus on new markets (24%) and better economic conditions in key markets (16%) are expected to also contribute to growth.

Investing in e-commerce brings returns for exporters

This year, 74% of exporters reported generating orders or enquiries via online channels. 1 in 3 (32%) businesses reported a decline in online export orders this year, while for 21% e-commerce channels brought increases to export orders. Of all exporters, 40% stated they are taking no action to drive online orders, up from 22% in 2019 – participation in all e-commerce growth strategies fell this year.

Export businesses which reported increases in revenue this year were more likely to actively participate in strategies to grow online orders. Top strategies among these successful businesses included improving website design (43%), more spend on online marketing (35%), and offering free or discounted delivery (26%).

Export expansion plans impacted by fall in 2020 revenue

Following the trend set in 2013, New Zealand remained the top export destination for Australian exporters with 73% engaging in trade across the Tasman, growing from 68% in 2019. The North America region held second place despite dropping to 39% from 52%. The South East Asia region was the third most popular destination (36%), up from 29%. Trade with the UK fell from 35% to 23%, while Europe dropped 6% to 30% this year.

Looking to the coming 12 months, two in three (65%) exporters stated they had no plans to expand into new overseas markets, an increase from 51% the previous year. This trend was observed most amongst exporters who reported a decline in export revenue this year – 70% stated they did not plan to expand in 2021. Among those who did indicate an intention to invest in new markets, the most popular target destinations included New Zealand (11%), South East Asia (10%) and the UK (10%).

The number of exporters experiencing barriers to trade, such as exchange rates and tariffs fell this year, with 41% reporting no challenges apart from pandemic-related issues. In light of the pandemic, the most common barriers encountered by exporters included delays and disruptions to freight deliveries (54%), increase in cost of freight (51%), temporary closure of local business operations at destination (29%), and lack of demand from customers (28%).