Whenever goods are shipped from one country to another, they must clear customs in the destination country. This process can be complicated, and it is important to have the right documentation such as the customs invoice in order to avoid delays.

When you start to ship internationally, not only do you have to deal with the logistics of getting your products to your customer, but you also have to navigate a complex web of customs regulations. From following Australia’s export requirements to packing your parcels properly, you may notice that you’re also required to prepare a customs invoice if you are shipping large volumes of goods.

Also known as a pro forma invoice, a customs invoice is a document that provides customs authorities with details about the shipment such as the names and addresses of the shipper and consignee, a description of the goods, and the country of origin. The customs authority then uses this information to assess duties and taxes on your imported goods.

If you're using customs brokerage or professional logistics services, they will usually have a customs invoice template for you to fill in the necessary information. However, if you're shipping on your own, it's important to make sure that you have met the customs invoice requirements for a quick clearance of your shipments. Inaccurate or incomplete information on the customs invoice can otherwise result in clearance delays, penalties, and other issues.

What is required on a customs invoice?

Your customs invoice must include the following information:

Name and address of the shipper and consignee

Description of goods

Quantity of goods

Total weight of goods

Unit Price

Total Price

Harmonised System (HS) code

Invoice number

Country of Origin of goods

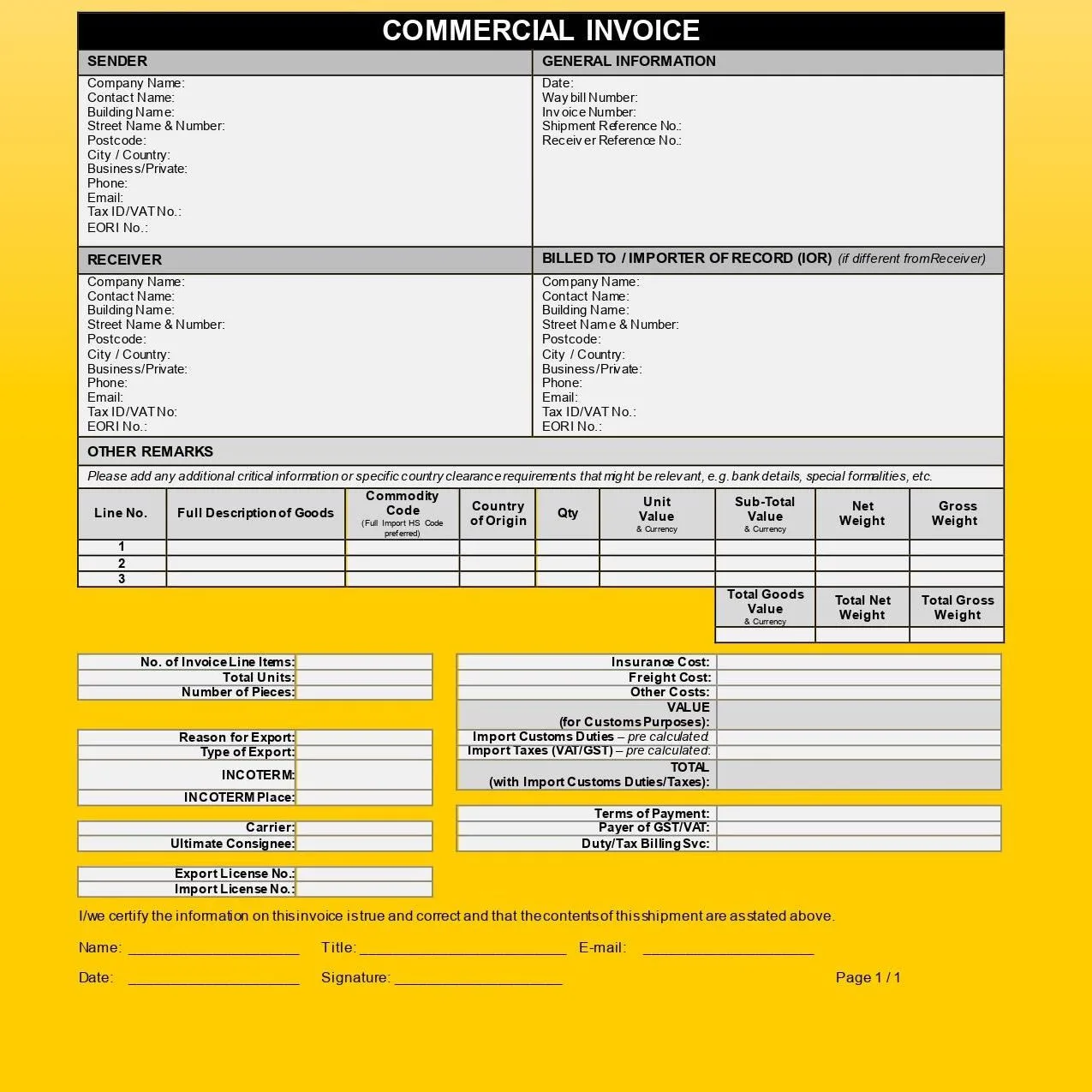

Sample of a customs/commercial invoice form

This is an example of the customs/commercial invoice format:

You can access the sample customs invoice via the MyDHL+ platform. The fields indicate clearly what you’ll need to fill.

Make sure to complete the customs invoice in full and avoid leaving sections blank to facilitate a smooth clearance of your goods. Once done, print the form and attach it on the outside of your package so that it is visible to customs officials. You may use a waterproof ‘documents enclosed’ envelope that can hold the customs invoice and other important shipping documents like the bill of lading securely during transit. However, some countries may have specific requirements for where the customs invoice should be placed, so it is always best to check before shipping.

Customs invoice vs commercial invoice

Among the documents needed for international shipments, it is a common mistake to confuse customs invoices for commercial invoices. While both may include similar information, they serve different purposes. A customs invoice or proforma invoice is used by both businesses selling products and personal shippers sending gifts or personal items. This piece of document is essential for products to clear a country’s border. The value of the product is stated and this is typically used for insurance purposes.

A commercial invoice has all the information of a customs or proforma invoice, including the value of a product. But unlike the customs invoice, this value is stated for duties and taxes purposes. If you have further questions, you can always reach out to global delivery service providers like DHL Express who are up-to-date with the customs clearance requirements overseas.

Ship confidently with DHL Express

If you are planning to ship goods overseas, it can make a difference when you have a reputable international logistics company to help you with the required documentation. With a presence in 220 countries and territories, DHL Express is a reliable logistics provider for businesses in Australia. To simplify your shipment preparation, you can easily develop the airway bill form, customs invoice and other shipping documents from the templates available on MyDHL+.

Get started by opening a DHL Express business account today. You may also check out our other guides on shipping internationally to learn about customs duty, import tax and more.

Disclaimer

Any regulatory information contained herein is for informational purposes only and DHL assumes no responsibility for the accuracy of the information. DHL does not provide specific regulatory or legal advice to the public and you are encouraged to seek your own legal or compliance counsel.