Have you considered shipping to Portugal? The country’s e-commerce market jumped by almost a third in 2020 – and it’s still growing… With the right market insights, customs knowledge, and of course an international shipping partner, your business can cash in on this emerging opportunity. Read on for a comprehensive guide to help your business export to Portugal.

MARKET OVERVIEW

A growing e-commerce opportunity

Revenue in Portugal’s e-commerce market is expected to reach US$4.7 billion in 2024, rising to US$7.6 billion in 2029(1).

Nearly half shop online

49%(2) of Portugal’s population of 10.2 million people(3) are e-commerce users. 39% of them make a purchase more than once a month, whilst 22% buy more than once a week(4).

Mobile commerce is big business

Portuguese online shoppers like buying via their smartphones; mobile commerce takes 36% of the country’s total e-commerce sales(5). Dedicated mobile shopping apps are particularly popular (versus browsers) due to their convenience.

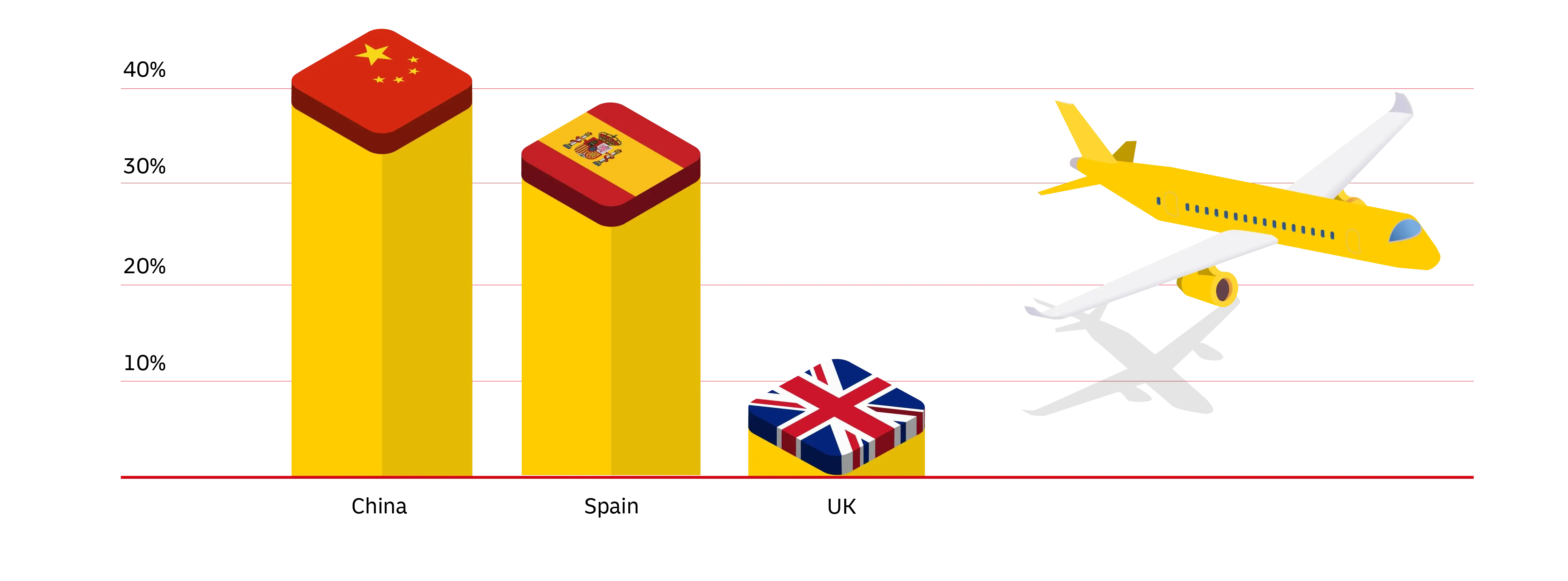

Where does Portugal import from the most?

There’s good news for international sellers: over 60% of Portuguese consumers have made a purchase from another country6.

EXPORT TO PORTUGAL: CONSUMER TRENDS YOU SHOULD KNOW

Where do consumers in Portugal shop online?

Online marketplaces can be a helpful gateway for cross-border businesses wishing to sell to a new country for the first time.

Most visited online marketplaces in Portugal8

- the country’s leading online destination for technology, home appliances and consumer electronics.

– the Chinese marketplace giant sells everything and anything, and many of its merchants ship cross-border.

– another e-commerce heavyweight, this marketplace lets Portuguese consumers shop with thousands of sellers across the world.

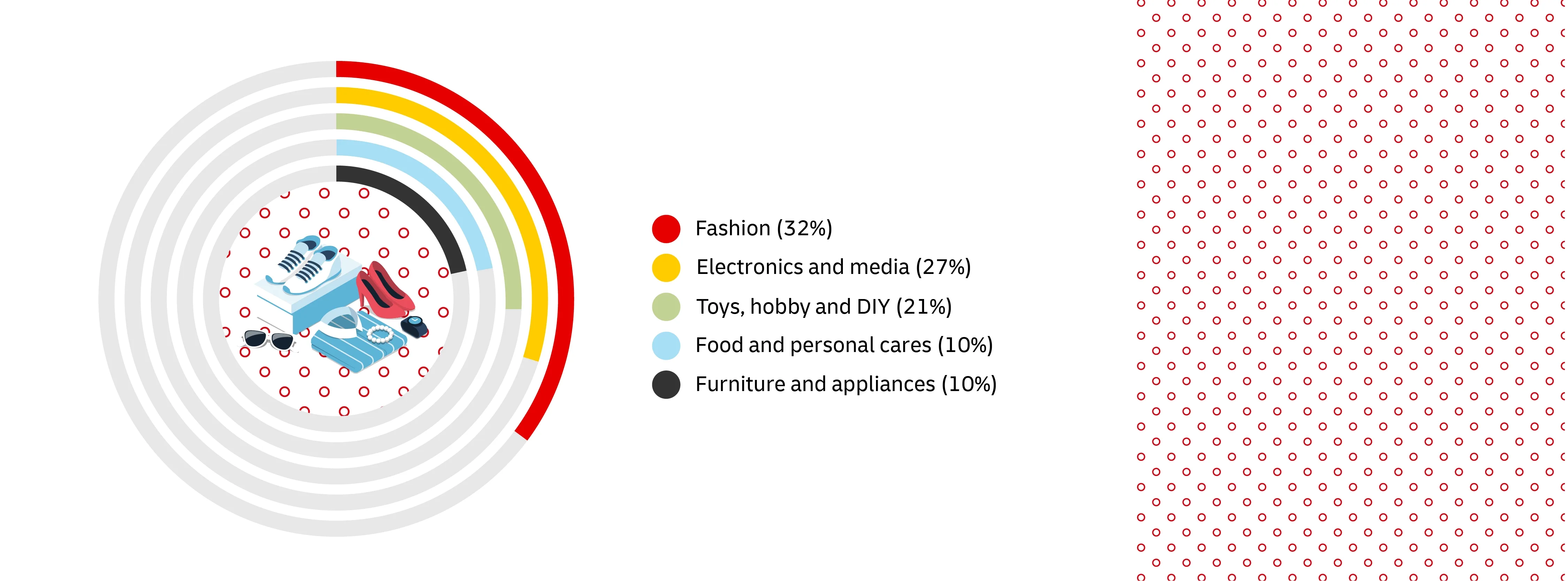

What are they buying?

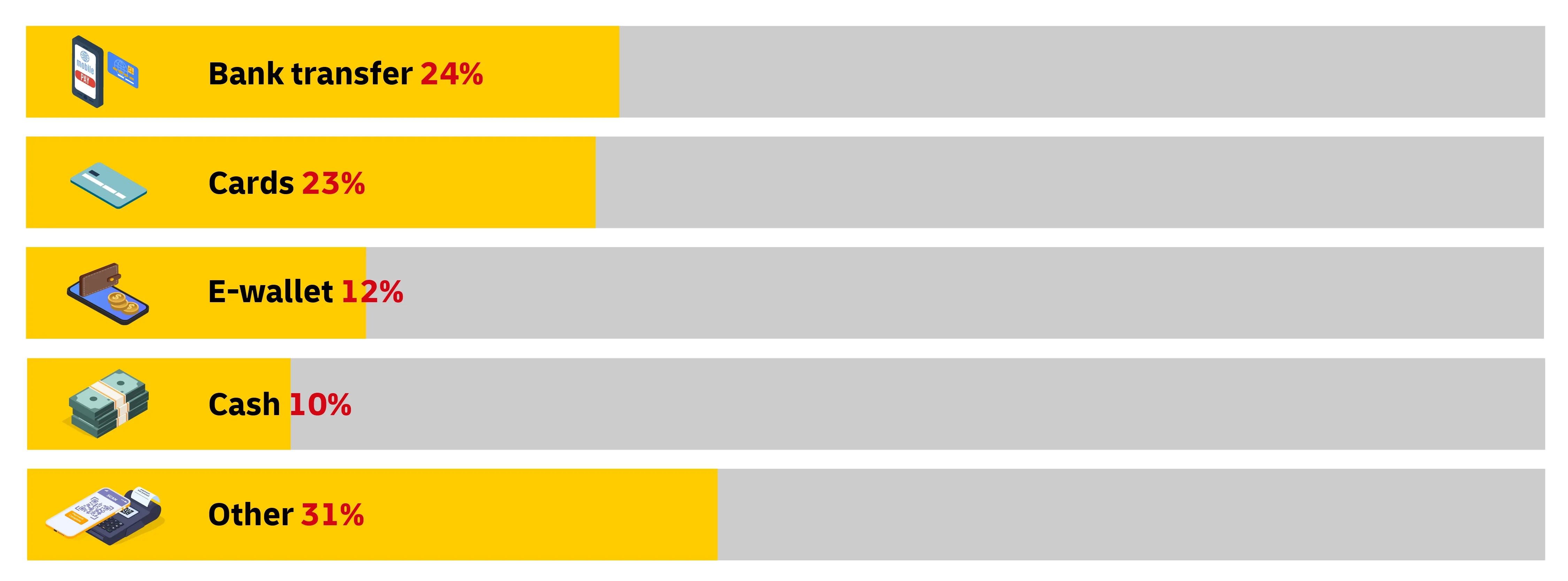

How do Portuguese consumers like to pay for their online purchases?

After all, e-commerce shoppers are more likely to abandon their carts if they cannot pay using their preferred payment method.

Popular online payment methods in Portugal10

What are Portuguese consumers’ leading concerns and preferences when shopping online?

(Source: Statista Consumer Insights11)

68% will do some research on the internet prior to making a major purchase

Dedicate plenty of time to building a social media strategy to showcase your brand in the best way.

57% find online customer reviews “very helpful”

Put lots of customer reviews on your e-commerce website to build trust with browsers.

30% want to see and touch an item before buying it

Invest in augmented/virtual reality tools on your product pages to give your online customers a better sense of the product.

24% said express shipping is a priority

With DHL Express, you can guarantee fast shipping to Portugal!

Leading shopping holidays in Portugal

Be sure to add these dates to your marketing and sales calendar so your business can prepare and cash in!

Father’s Day, March 19 & Mother’s Day, the first Sunday in May

People will be busy buying gifts for their parents, creating a big opportunity for e-commerce businesses to win some sales.

Valentine’s Day, February 14

The most romantic day of the year and a very lucrative time for chocolate, jewellery and flower businesses!

Amazon Prime Day, July

Selling on Amazon? Then this day is likely already marked out in your calendar. Prepare to roll out some big discounts!

Black Friday/Cyber Monday weekend, November

Portugal joins many other countries in partaking in this global sales bonanza. Competition is fierce, so you’ll need to offer some big deals to entice Portuguese consumers through your online doors.

Christmas Day & New Years Eve, December

These dates are widely celebrated in Portugal. Expect to see a surge in e-commerce traffic throughout December – offering express delivery will help you win the last-minute shoppers, too!

SHIPPING TO PORTUGAL

Portugal customs regulations: required documentation

When shipping internationally, there are several pieces of documentation commonly required to clear your goods through customs smoothly, and help authorities determine what import taxes and duties are due:

- Commercial Invoice

- Bill of Lading

- Air Waybill

- Certificate of Origin

- Export and Import Licenses

- Export Packing List

- Insurance Certificate

Prohibited and restricted commodities

Several commodities are not permitted for shipment by DHL under any circumstances, following full consideration by the operational, legal and risk management teams. They include animals, hazardous or combustible materials, and illegal narcotics. Further information can be found here.

Useful resources

For in-depth information on Portugal trade agreements, check out:

International Trade Administration – Portugal Commercial Country Guide: Portugal - Customs Regulations

AICEP Portuguese Trade & Investment Agency: AICEP Portugal Global

EU VAT rules & rates: VAT rules and rates: standard, special & reduced rates - Your Europe

Shipping costs

Unless exempt, all imported commercial goods are subject to customs duties and taxes based on their Harmonised System (HS) Code tariff classification. Generally speaking, it is the Importer of Record (i.e. either your business or your chosen logistics carrier) who will pay the import duties and taxes.

You can find the correct HS code for your shipment easily via DHL’s MyGTS (My Global Trade Services) – a free, user-friendly platform that will help you navigate all aspects of international shipping. This includes calculation of Landed Cost for goods in any country – i.e. your product cost, duties & taxes, and freight charges – enabling you to enhance your pricing strategy and give your customers transparency over shipping fees.

DHL’s expert tips for shipping to Portugal

- Direct delivery to their home address is the most popular shipping method for Portuguese consumers. With DHL’s On Demand Delivery service, they can choose a date and time that suits them, with full tracking.

- Consider shipping your goods as Duties & Taxes Paid (DTP). Whilst the payment of duties and taxes on international shipments is typically the responsibility of the receiver – i.e., your customer – DHL does offer a DTP service to account holders. This means DHL will invoice the shipper (your business) to cover the costs. The benefit of this is the end customer will not receive an unexpected tax bill when their package arrives at customs – which may damage their opinion of your brand.

- Offering free returns can be an effective way to build trust amongst Portuguese consumers, by demonstrating your business’s belief in the quality of its products and commitment to customer satisfaction.

Portugal Export FAQs

Obtain an EORI Number: Before exporting, ensure you have an Economic Operator Registration and Identification (EORI) number. This unique identifier is necessary for customs purposes.

Understand Customs Procedures: Familiarise yourself with customs procedures and documentation requirements. This includes export declarations, invoices, packing lists, and certificates of origin.

Check Tariffs and Duties: Research applicable tariffs and duties for your specific goods. Portugal is part of the EU, so you’ll need to comply with EU regulations.

Ensure Compliance with Regulations: Be aware of product-specific regulations (e.g., labeling, safety standards) and ensure your goods meet them.

Choose a Shipping Method: Decide on the most suitable shipping method (e.g., road, sea, air) based on your product type and urgency.

Work with a Freight Forwarder or Carrier: Consider using a freight forwarder or carrier to handle logistics and transportation.

Communicate with Portuguese Importers: Establish communication with potential importers in Portugal to understand their requirements and preferences.

Commercial Invoice: Provide a detailed invoice with information about the goods, their value, and terms of sale.

Bill of Lading or Air Waybill: These documents prove ownership and serve as evidence of shipment.

Certificate of Origin: If applicable, obtain a certificate of origin to confirm the country of origin for your goods.

Packing List: Include a packing list detailing the contents of each package.

Export License (if required): Some goods may require an export license; check if your products fall into this category.

Other Specific Documents: Depending on the nature of your goods (e.g., hazardous materials, perishables), additional documents may be necessary.

Customs Declarations: Submit accurate export declarations through the National Export System (NES) or use a customs agent.

Transit Procedures: Understand transit procedures if your goods pass through other EU countries before reaching Portugal.

VAT and Duties: Be aware of Value Added Tax (VAT) and import duties applicable to your goods.

Incoterms: Choose the appropriate Incoterm (e.g., EXW, FOB, CIF) to define responsibilities between you and the buyer.

Thinking of exporting to Portugal?

You’re in the right place! We know that the above guidelines may seem a little overwhelming, but that’s where partnering with DHL Express will pay off. As international shipping experts, we’ll support you through all customs procedures so that your shipment avoids delays. Sell to the world with DHL!

Start your journey here