Covering 12 international flows across 169 countries and territories, the DHL Global Connectedness Index provides the most up-to-date picture of the world we live in today – and where best to find your next trading partner. But what countries are excelling, and which are on the back foot?

Now in its seventh edition, the GCI explores global 'connectedness' – the extent to which any given country is connected to others globally, measured based on actual interactions that take place between its citizens and other countries. It does this by considering depth (how much of their activity is domestic versus international) but also breadth (how many countries the international activity is shared among).

It's about more than just international trade; it's also about communication and migration. This update of the DHL Global Connectedness Index was calculated based on more than 3.5 million data points on country-to-country-flows. It provides full coverage from 2001 to 2020, along with partial analysis of the first half of 2021. The report also features a deep dive into the U.S.-China trading relationship, tracing the sharp decline in U.S.-China trade, as well as an examination of recent claims that globalization is giving way to regionalization.

“International exchange empowers people and businesses around the world to collaborate and seize new opportunities,” comments John Pearson, CEO of DHL Express. “While current geopolitical tensions could seriously disrupt global connectedness, this 2019 update finds that most international flows have remained surprisingly resilient so far. Ultimately, what we’re seeing today is the evolution of globalization, not its decline. Decision-makers need to be careful to not overreact to strong rhetoric or headlines.”

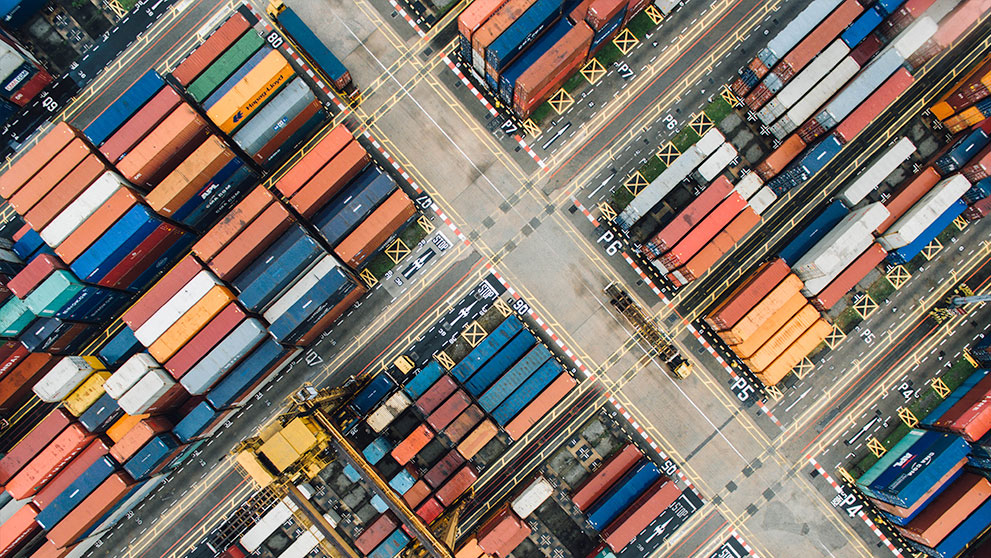

Trade and capital flows: lower, but no sign of a collapse

As the GCI update shows, trade flows continued to intensify through the early stages of the U.S.-China trade war in 2018. However, this strength did not extend into 2019. In the first half of this year, the share of global output traded across national borders fell. While trade volume growth is likely to remain positive this year, it is not expected to keep pace with GDP growth. Nonetheless, current forecasts suggest that trade intensity is on track for only a modest decline through 2020.

Capital was the only pillar of the index that declined in 2018. In fact, the pullback in global connectedness was entirely driven by shrinking international capital flows, specifically foreign direct investment (FDI) and portfolio equity investment. While early capital flow data for 2019 suggest some stabilization, a robust recovery on these metrics remains elusive. However, a large part of the recent FDI drop was due to U.S. tax policy changes, which have prompted U.S. multinationals to repatriate earnings held abroad. This suggests that fundamentals may be stronger than they appear, with no broad retreat from corporate globalization underwa

Global information and people flows: still advancing

The globalization of information flows continues to progress, but available measures point to a possible slowdown. While growth of international communications has typically far outpaced the growth of domestic communications since at least the early 2000s, recent data suggest that both are now growing at more similar rates. Global people flows also continue to advance. Outbound travel from emerging economies and liberalization of tourist visa requirements have given international tourism a significant boost. Despite public policy controversies, international migration also continues to grow.

Domestic business activity still dominates

Looking ahead, the 2019 update notes that all four flows measured by the DHL Global Connectedness Index— trade, capital, information and people—are currently running up against powerful headwinds. Rising barriers and uncertainty about future openness are starting to carry significant costs. At the same time, a survey on globalization perceptions reveals that many people do not realize how limited global connectedness actually is. While the world is more connected than at almost any previous point in history, most business still takes place within rather than across national borders. The report highlights how such exaggerated perceptions of globalization can lead to distorted decision-making in business and an underestimation of the significant potential available from further increases in global connectedness.

To explore the GCI in full and see how your country stands up in relation to the rest of the world, click here.