The Philippines, an archipelago of 7,641 islands, is home to over 111 million people, making it one of the most populated countries in the Asia Pacific1. With impressive GDP and e-commerce growth, and an expanding middle class, the market presents an exciting opportunity for cross-border businesses.

5.4% decrease in poverty in just 6 years

The poverty rate declined from 23.5% in 2015 to 18.1% in 2021(2). This improves the lives of many Filipinos, and is also an indicator of the country’s positive economic direction of travel.

Steady GDP growth

The GDP of the Philippines has grown consistently at around 6% for the last several years(3) (with the exception of 2020, when the pandemic disrupted the economy) – a figure which is expected to remain constant through 2028.

12.93% e-commerce growth to 2027(4)

Strong and sustained e-commerce market expansion through to 2027 – a sign that the Philippines is a good candidate for any overseas exporter looking for new markets to target.

43.9% internet penetration rate

The e-commerce penetration rate sits at 43.9%, and is forecast to grow to 48.6% by 2028(5).

E-commerce ARPU

In 2022, the average revenue per e-commerce user in the Philippines was US$379.1(6). This compared to a global average of US$1,320(7).

Leading e-commerce websites in the Philippines8

Shopee and Lazada are the dominant e-commerce marketplace players in the Philippines. Between them, they take the majority of market share, but other global marketplaces are also popular in the Philippines.

Shopee is a household name in the Philippines, scoring over 70 million visits every month.

Like Shopee, Lazada is well-known, receiving around 35 million visits every month.

Asian fashion marketplace Zalora is one of the most popular online destinations for a range of branded fashion items.

The globally recognised marketplace for used and new purchases.

Carousell, formerly OLX, sells second-hand items, from mobile phones to cars and even houses.

Amazon is not a major player in the Philippines and does not have a local market website, but it does ship to many addresses in the country.

Most popular product categories online in the Philippines (as of June 2022)9

Fashion, food, consumer goods and beauty products are the major categories of e-commerce in the Philippines

* % of consumers who had purchased from that category in the previous three months

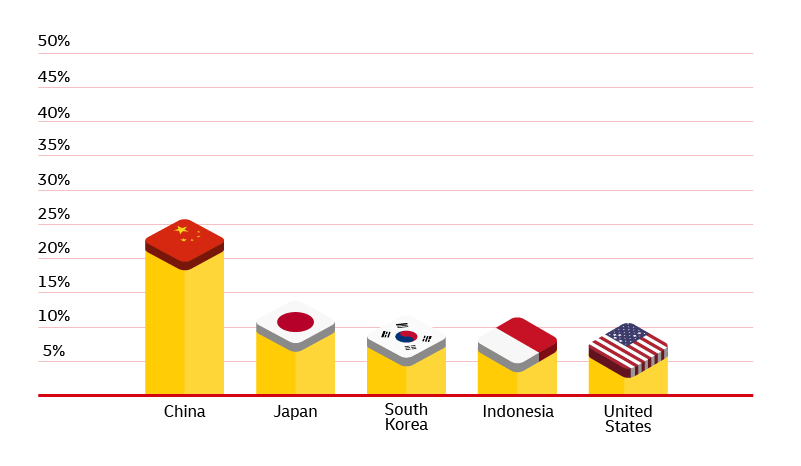

The biggest importing countries into the Philippines10

Around a fifth of all of the Philippines’ imports come from China. In 2021, the country’s leading import partners were:

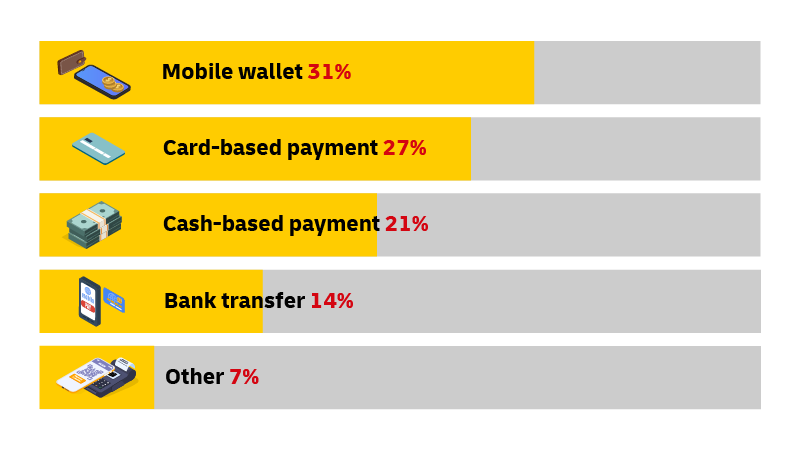

Leading payment methods in e-commerce transactions in the Philippines in 202211

Major shopping events and holidays

The Philippines has several shopping events and holidays throughout the year. You can read in more detail here:

New Year's Day (1st Jan)

New Year's Day is a great time for businesses to offer shopping sales and discounts on their products and services. New Year's Day is also a national holiday in the Philippines, which means that Filipinos will likely have more time to browse and shop online.

Mother’s Day (2nd Sunday of May) & Father’s Day (3rd Sunday of June)

Top products to sell online include products and services that would be popular with mothers, like flowers, jewellery, and spa packages. Meanwhile, gifts that are popular for Father's Day include items like electronics and sports equipment.

Singles’ Day (11 Nov)

In the Philippines, 11.11, also known as Singles’ Day, is considered one of the best online sales days for businesses. Extremely popular within the Asian region, this is a great opportunity for businesses to sell products that are typically sold in pairs, such as shoes, earrings, and earpieces.

Black Friday, Cyber Monday (Monday after Black Friday) & Boxing Day (26th Dec)

Savvy Filipino shoppers know that some of the best deals online can be found on these two back-to-back shopping holidays. Black Friday takes place on the Friday immediately after Thanksgiving, while Cyber Monday falls on the Monday after Black Friday.

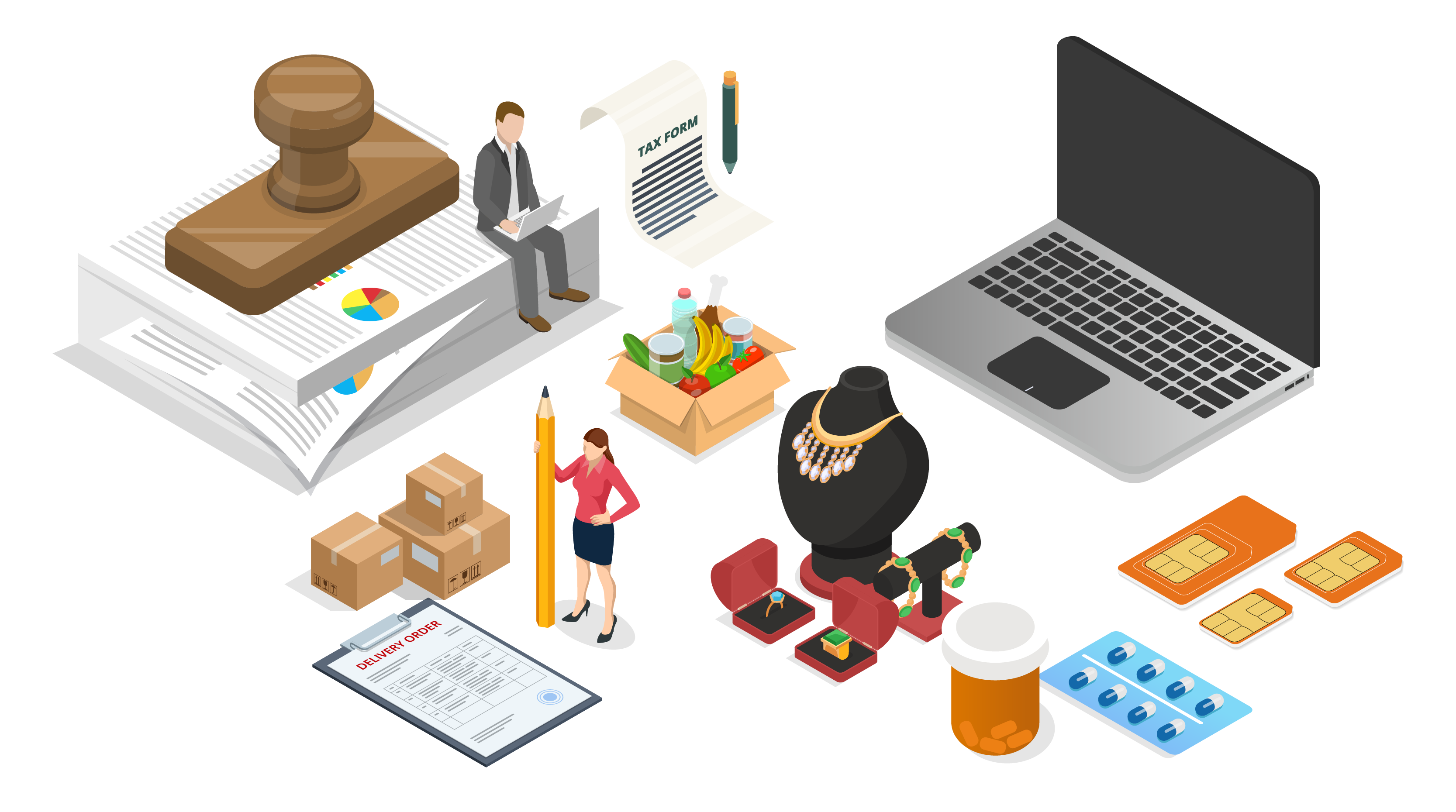

The Philippines’ customs and import regulations

Import tax in the Philippines is straightforward, but you still need to know what you’re doing to avoid paying penalties.

Documents required for importing goods

- A sales invoice that shows the commercial value of the goods

- A packing list with detailed information regarding the products

- Supplemental Declaration on Valuation (SDV)

Depending on the types of goods being imported, additional documents may be required, including the following:

- Import license for the Philippines or permit

- Certificate of origin for those products covered by preferential tariffs under free trade agreements.

- Other documents and certificates that prove exemption from taxes and customs fees in the Philippines

- Authority to Release Imported Goods (ATRIG)

- Tax Credit Certificate (TCC)

- Tax Debit Memo (TDM)

- If a ruling was used in goods declaration, a copy of the verdict is required.

The de minimis threshold is shipment values of below 10,000 PHP

Shipments under this value will not pay duties or taxes but a fee of PHP 430 is levied by Philippines authorities for each shipment.

Shipments over PHP 10,000 require formal clearance, and the applicable duty rate applies according to the HS code along with VAT of 12%.

Don’t split shipments to avoid taxes

Splitting shipments to avoid the de minimis threshold could cause delays or penalties.

Regulated products and categories

- Electrical items need Bureau of Product Standard (BPS) clearance.

- Jewelry is subject to excise tax.

- Tokens, USD and SIM Cards are subjected to Customs verification.

- Hard Drives need clearance from the Optical Media Board (OMB) and are subject to additional fees.

- Telecommunications equipment needs National Telecommunications Commission Permit and/or clearance and is subject to additional fees.

- Food and drugs need Food and Drug Administration (FDA) Permits and are subject to additional fees.

Exporting to the Philippines: Official websites and useful links

- Philippines Customs: https://customs.gov.ph/

- Philippine Economic Zone Authority (PEZA) requirements and regulations, visit: https://www.peza.gov.ph/

- For food and drug import requirements and restrictions, contact the Food and Drugs Administration Philippines. https://www.fda.gov.ph/

For more information on exporting to the Philippines, read the DHL guide.

DHL’s expert tips for exporting to the Philippines

- The importer should register with the Philippines Bureau of Customs.

- If the shipment is regulated, it should have a permit from the relevant Philippines government agency. You can find a list of regulated goods here.

- The complete and correct value should be declared to avoid seizure of the goods.

- The description should be specific and detailed.

- Avoid mistakes if you can—there’s a penalty for clerical errors.

- Partner with a reliable logistics provider that has expertise in navigating the complex rules and regulations of the Philippines customs and import/export processes.

- You can find the correct HS code for your shipment easily via DHL’s MyGTS (My Global Trade Services) – a free, user-friendly platform that will help you navigate all aspects of international shipping. This includes calculation of Landed Cost for goods in any country – i.e. your product cost, duties & taxes, and freight charges – enabling you to enhance your pricing strategy and give your customers transparency over shipping fees.

Tips on successful importing into the Philippines

Here are three tips on successful importing into the Philippines:

- Understand import regulations: Before exporting to the Philippines, it’s important to understand import regulations such as customs duties and taxes.

- Partner with a local distributor: Partnering with a local distributor can help you navigate local regulations more easily.

- Research your target market: Researching your target market can help you understand consumer preferences better.

Offer a seamless e-commerce service with DHL DTP

With DHL DTP (Duty and Taxes Paid), the seller pays the import duties, taxes, and other fees associated with shipping the product, allowing the Filipino consumer to receive the product without any additional costs or fees.

DHL DTP is a valuable service for cross-border sellers looking to reach Filipino consumers. By offering a seamless and hassle-free shopping experience, sellers can increase customer satisfaction and loyalty, and build a strong brand presence in the Philippine market.

Thinking of exporting to the Philippines?

Our complete international shipping service helps you ship quickly and reliably.

Find out more