As a business owner or individual looking to send shipments internationally, understanding the different types of documents required for global shipping is crucial.

Among these, the commercial invoice stands out as one of the most vital.

A commercial invoice is an export document that acts as a customs declaration for all international shipments with a commercial value, except for documents. It includes essential details such as the item descriptions, values, and the transactions between the buyer and seller.

The commercial invoice should be prepared before or at the time of booking your shipment. It must be included with other shipping documents to facilitate a smooth shipping process, as it is required for customs clearance. Customs authorities use this document to assess applicable taxes, tariffs, and duties, and to determine whether the goods can enter or exit a country.

This article guides you in creating an effective commercial invoice for customs and highlights its significance in international shipping.

Commercial Invoice Information

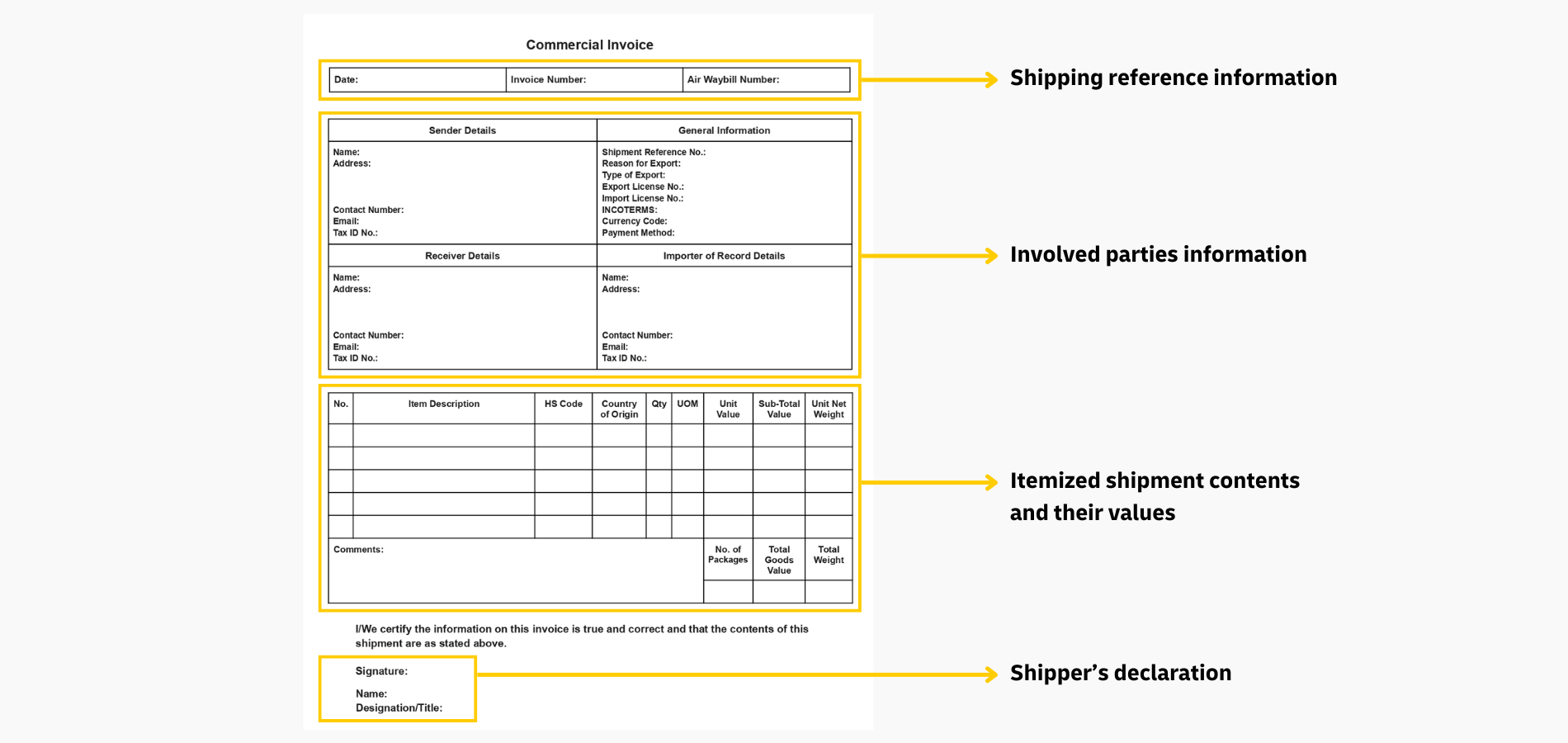

There is no single standardized format for a commercial invoice.

It varies depending on the logistics provider and business, but for customs clearance in international shipping, it must cover at least three essential categories of information:

- Shipping reference information

- Details of the parties involved

- Shipment contents and their value

How to Fill Commercial Invoice

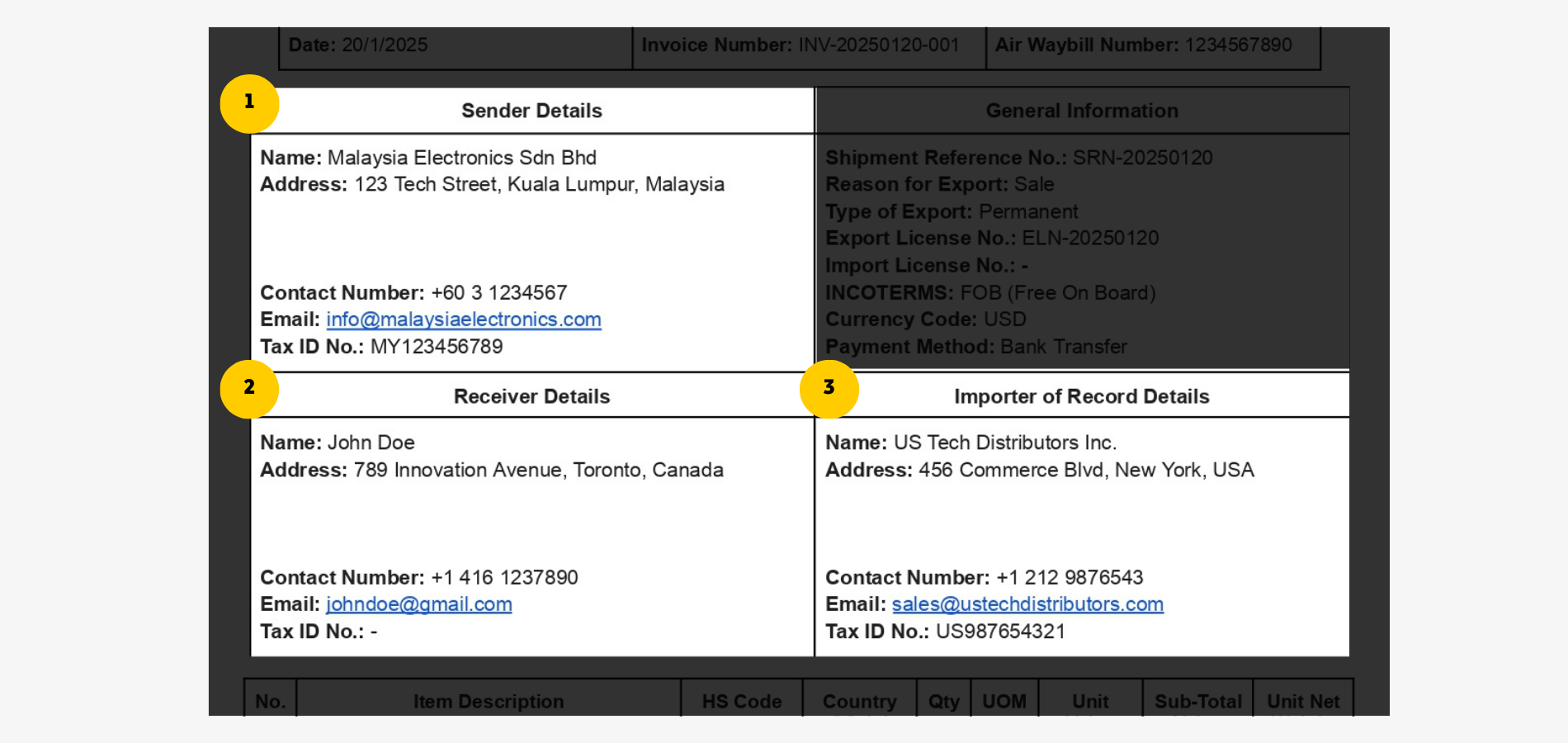

Details of Involved Parties

To facilitate smooth customs processing, the following details must be provided for every party involved in the shipment:

- Name: Individual or company name.

- Full Address: Include street, number, city, country, and postal code.

- Contact Information: Phone number and email address.

- Tax Identification Number: For businesses, include relevant tax identification numbers as required by export or import regulations (e.g., SST, TIN, VAT, GST, or EORI number).

The shipping process typically includes the following entities:

- Sender

- Receiver (Consignee)

- Importer of Record (IOR) – This may be a distributor, broker, or another responsible party.

In standard cases, shipments involve only one consignee, meaning only "receiver" details are required.

However, if multiple parties participate in the importing process, details of all additional entities must be included under the "importer of record" (IOR).

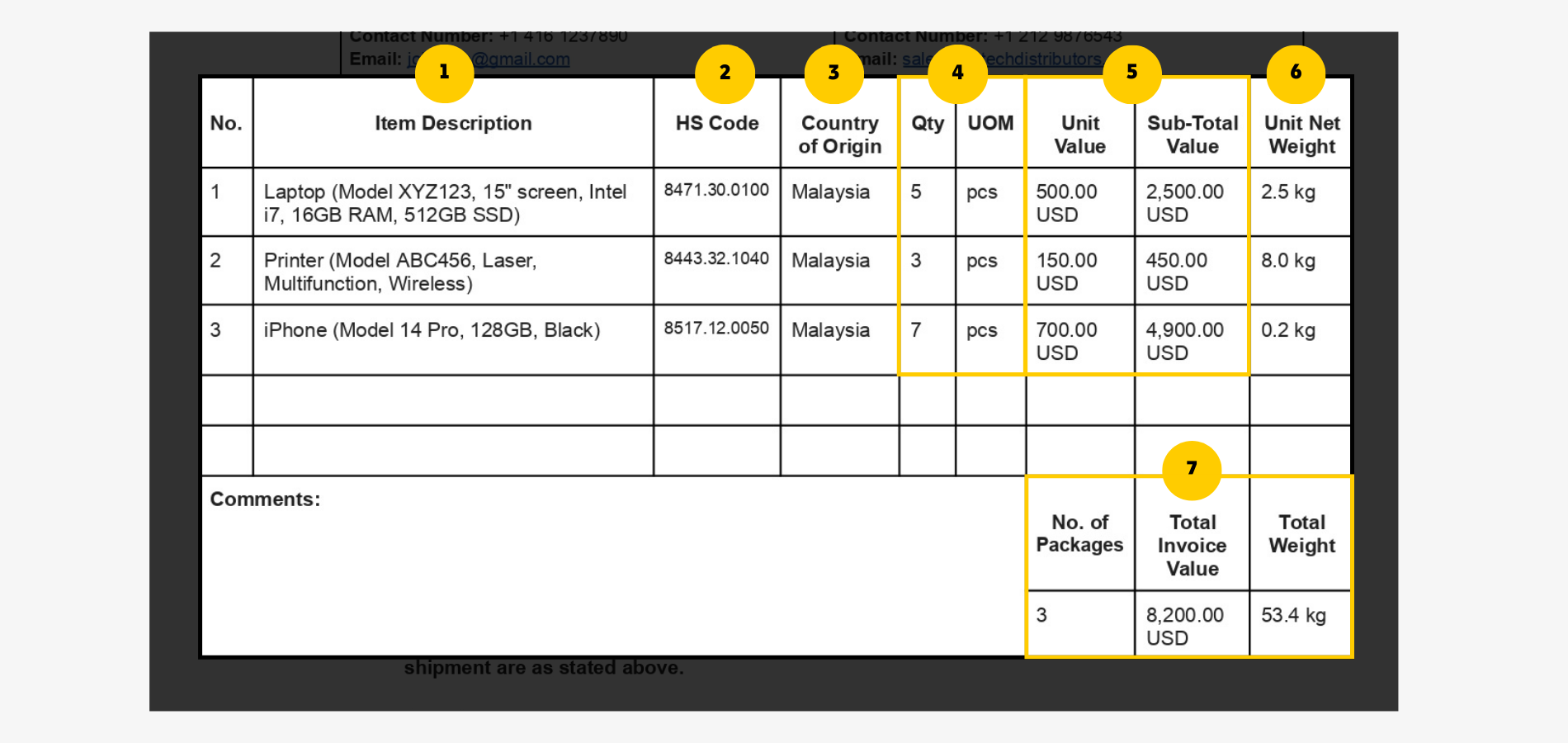

Shipping Contents and Their Values

Contents of the shipment must be laid out in details made of 6 essential information:

- Goods descriptions

- Harmonized system code (HS Code)

- Country of origin (COO)

- Quantity and unit of measure (UOM)

- Unit and sub-total value

- Unit net weight

- Shipment summary

Goods Descriptions

A complete description of an item should specify what it is, the materials it is made of, and its intended use.

When describing goods, be as specific as possible. If applicable, include additional details such as the brand name, model, or serial number.

The table below provides examples of acceptable and unacceptable goods descriptions.

| Acceptable | Unacceptable |

|---|---|

| Apparel, clothes, clothing | Men's shirts, made of 50% cotton and 50% polyester. |

| Appliances | BrewMaster coffee machine (Model CM100) |

| Smartphone (iPhone 14 Pro, 128GB) | |

| Household goods | HomeWare 10-inch ceramic plates |

| Medical equipment | Medicare adhesive bandages (assorted sizes, 100 pieces per box) |

| Pharmaceutical, medicines | HealthPlus Cough Syrup (200ml bottle, cherry flavour) |

| Samples | Samples of curtains, made of 100% cotton |

| Parts | Parts of pumps for liquids, fitted with a measuring device made of 100% steel |

Harmonized System Code (HS Code)

A six-digit HS code classifies products in international trade, enabling customs authorities to apply the correct duties, taxes, and regulations.

Since HS codes differ by country, you may need to provide both the exporting and importing country’s HS codes.

To check the HS code for Malaysia, see our Malaysian HS code guide. For other countries, refer to our international HS code guide.

Country of Origin

Country of origin refers to the country where the goods were manufactured or produced, not the country from which they are being shipped. If a product is made in more than one country, you should list all the relevant countries.

For businesses looking to benefit from reduced or zero import taxes under Free Trade Agreements (FTA), a Certificate of Origin (CO) must be included for each applicable items. This document serves as proof of eligibility for these tax benefits.

Quantity and Unit of Measure (UOM)

The quantity of items being shipped and their respective measurement units (e.g., pieces, kilograms) must be clearly specified for each item in the shipment.

Unit and Sub-total Value

Each item in the shipment must have a unit value, which is the price per unit, and a total value, calculated by multiplying the unit price by the quantity.

Unit Net Weight

This refers to the weight of the item, excluding packaging.

Shipment Summary

This section should consist of the following:

- Number of Packages: The total number of packages in the shipment.

- Total Value: The combined value of all items in the shipment.

- Total Weight: The combined weight of all items in the shipment, including packaging.

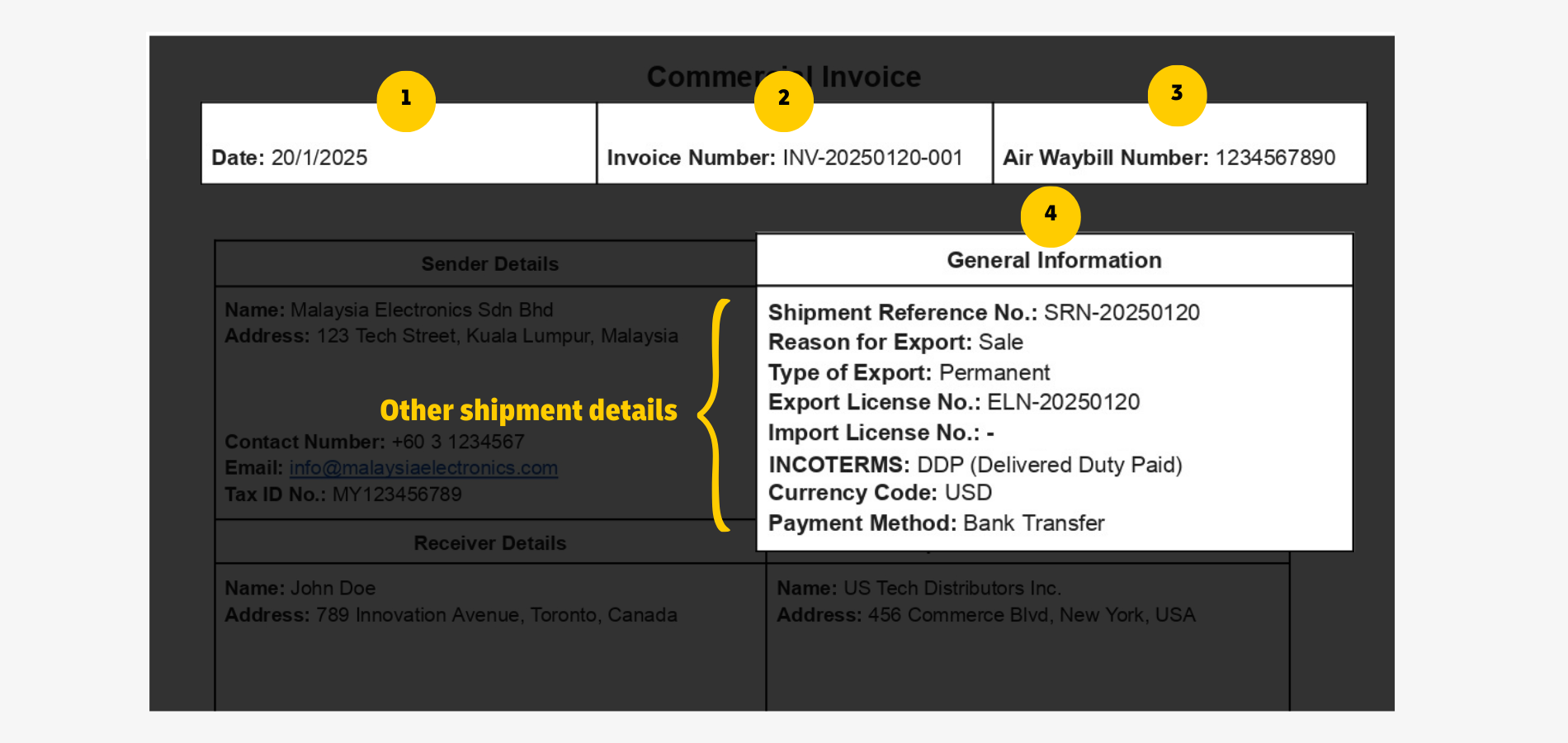

General Information

Besides the two high-stakes categories mentioned above, which have a direct impact on compliance and finances if entered incorrectly, general shipment information is key for maintaining records, verifying shipments, and tracking.

This information usually appears at the top of a commercial invoice.

It consists of critical details of the shipping process and the agreed-upon transaction terms between the parties involved, such as:

- Invoice date

- Invoice number

- Air waybill

- All other important shipping-related information

Shipping Contents and Their Values

Contents of the shipment must be laid out in details made of 6 essential information:

- Goods descriptions

- Harmonized system code (HS Code)

- Country of origin (COO)

- Quantity and unit of measure (UOM)

- Unit and sub-total value

- Unit net weight

- Shipment summary

Invoice Date

The date when the invoice is created.

Invoice Number

A unique, customisable number assigned to each invoice by the shipper or business for record-keeping purposes. It can be generated in various ways, but combining the date and a sequential number is the most common method.

Air Waybill (AWB) number

A tracking number for air shipments, allowing the sender and receiver to track the shipment through the logistics company's system. If you are shipping with DHL Express, the AWB number is 10 digits.

Shipping-related information

This section should cover all other essential shipment details, as below:

- Shipment Reference Number

- Reason for Export: The purpose of sending the goods across borders. Common reasons include:

- Gift: Items being sent as gifts to someone.

- Sample: Products sent for evaluation or demonstration.

- Replacement: Items sent to replace previously sent goods.

- Personal Use: Goods not intended for resale but for personal consumption.

- Sale: Items being sold to the recipient.

- Repair: Goods sent for repair services.

- After Repair: Items returned after repair.

- Type of Export:

- Permanent: Most exports fall under this category, where goods are shipped without the intention to return.

- Temporary: Goods shipped under Temporary Import or ATA Carnet, intended for return.

- Repair & Return: Goods sent for repair and then returned.

- Export/Import License Number: Certain shipments require specific licenses to comply with local regulations such as importing electronics into Malaysia requires a SIRIM Permit.

- Terms of Trade (INCOTERMS): Standardized international shipping agreements that define the responsibilities of senders and receivers, such as:

- Who pays for shipping, insurance, and customs costs: Determines the financial responsibilities of each party.

- Who handles transportation and to where: Clarifies who is responsible for moving the goods and their destination.

- Who is responsible for the goods at each stage of shipping: Outlines when the responsibility and risk for the goods transfer from one party to the other.

- Currency code: The type of currency used for the transaction.

- Payment method: The agreed-upon method for making payment, such as credit card, bank transfer, or online payment platform.

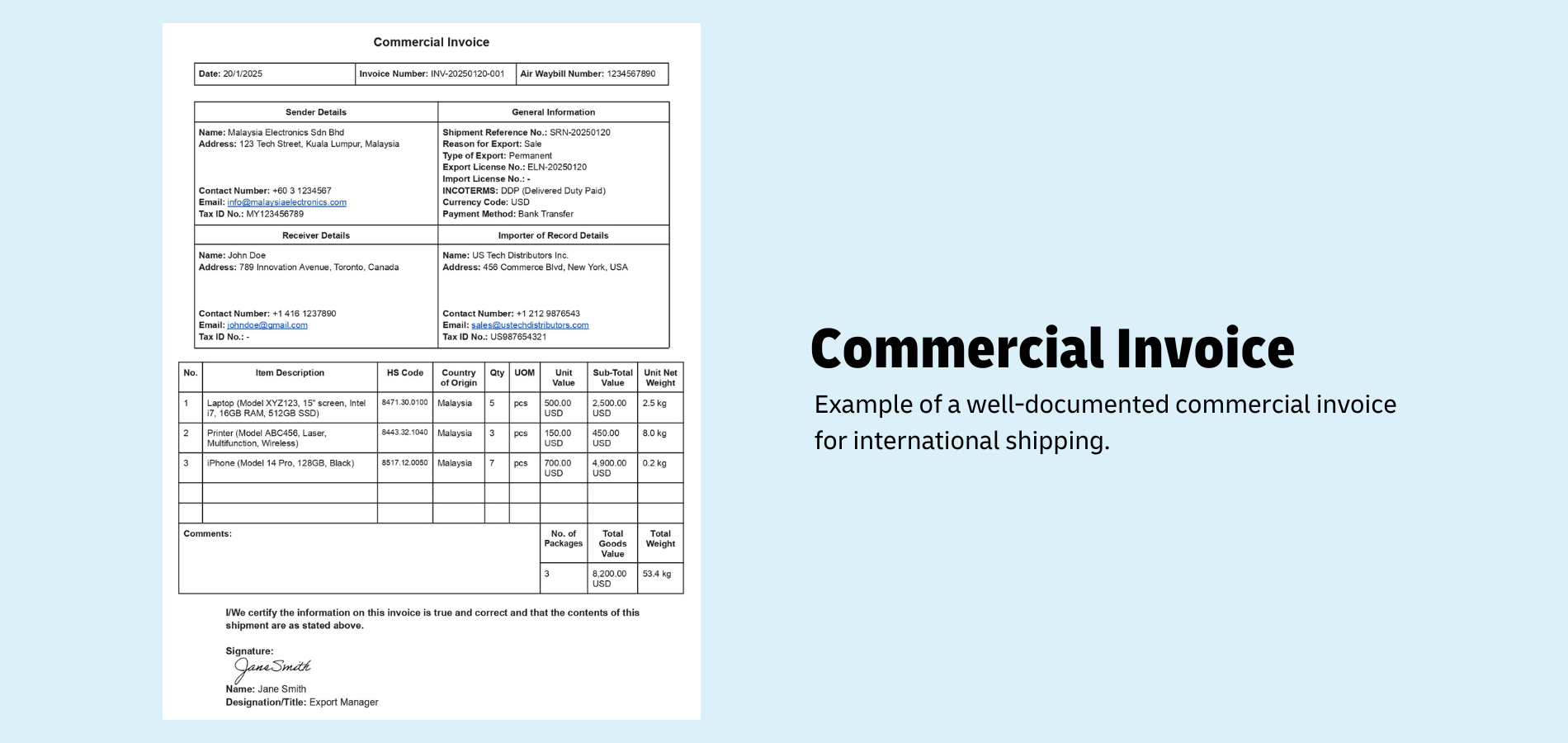

Sample Commercial Invoice

This is a sample of how a complete commercial invoice should look like.

A commercial invoice is a mandatory document for all international shipping of good items.

If you're shipping with DHL Express, there's no need to worry about preparing this document separately. As you enter shipment details on MyDHL+ for shipment booking, the system intuitively generates a commercial invoice.

Follow our step-by-step guide to book a shipment, which comes with a copy of commercial invoice at the end of the process.

Frequently Asked Questions

Yes, you will need a commercial invoice whenever you ship internationally as it is a requirement during customs clearance.

Every commercial invoice might be slightly different from the other. You can download our commercial invoice template here (pdf link) and use it to fill in the required info.

The elements below are required to form a commercial invoice that is legally binding.

- Bank Details, Shipper and Receiver Details

- Goods Description

- Commodity Code

- Origin Country

- Invoice Total Declared Value

- Type of Export

- Terms of Trade (Incoterms)

- Reason for export

- Air waybill number

- Harmonized Tariff Code

- Unit Net weight and subtotal weight.

Learn more about these elements required in a commercial invoice!

Yes, a commercial invoice serves as a contract and proof of payment made by the buyer to the seller.

Read more about commercial invoices!

Yes, commercial invoices are legally binding documents as It contains crucial details about what is inside a package and who is responsible for paying customs fees.

Commercial invoices also aid the customs authorities to decide if import taxes are required for the cargo shipped.

No, you cannot. A pro forma invoice is a document that states the offer or preliminary bill from the seller to provide specific products at a given price. Instead, you will require a commercial invoice for customs clearance.

Find out more about the differences between pro forma invoices and commercial invoices.

A pro forma invoice often serves as a preliminary document that lists the details and the anticipated charges of a proposed transaction. In other words, it is given by an exporter (vendor) to a potential importer (customer) before the delivery of a product or service.

Its main idea is just to provide buyers with an idea of how much money they might need to anticipate paying for the goods or services ordered.

It is the responsibility of an exporter to issue a pro forma invoice as pro forma invoices are just a document of declaration or quotation by the seller to the buyer.

Importers will require a proforma invoice as they might want to evaluate the proposed prices set by the exporters regarding the product and services that an exporter might want to provide in the future.

Click here to know more about pro forma invoices.

The exporters will be the party to prepare a pro forma invoice. However, a pro forma invoice is provided before the goods are sent to the consignee as it is a document to highlight the proposed price for a product or service.

When goods are received by the consignee or recipient, they will instead receive a commercial invoice instead of a pro forma invoice.