As imported goods arrive in Malaysia, they are subject to sales tax, along with excise duty and import duty.

In Malaysia, sales tax falls under the Sales and Service (SST) system, which was introduced in 2018 to replace Goods and Services Tax (GST).

There are two types of sales tax - sales tax on taxable goods and sales tax on low-value goods (LVG).

Sales Tax on Taxable Goods | Sales Tax on Low-Value Goods (LVG) | |

Applies to | Taxable goods imported into Malaysia or manufactured domestically and subsequently sold, used, or disposed of | Goods with a sales value of RM500 or below delivered from overseas to customers in Malaysia |

Who has to pay | Importer | Buyer |

Point of Tax Payment | Upon goods importation | Point of purchase/checkout (at the time when the consumer purchases the product online) |

Rates | 10%, 5%, and specified rate | 10% |

Goods excluded | Goods listed in the Sales Tax (Goods Exempted From Sales Tax) Order 2022 |

|

Payment method |

| Online marketplace |

Sales Tax on Taxable Goods

Sales Tax applies to all taxable goods imported into Malaysia or manufactured domestically and subsequently sold, used, or disposed of.

This tax is imposed upon the importation of goods and is calculated based on the purchase price of specific items.

Consumers are responsible for bearing this charge.

Rates

For this category, there are three different rates - 10%, 5%, and a specified rate.

To quickly determine the rates for your goods, check them on JKDM site using HS code or you can get a duty estimation instantly through MyGTS.

10% Duty Rate: Standard rate that applies to most goods

5% Duty Rate: Reduced rate that applies to only selected essential goods, such as basic foodstuffs, building materials, and certain electronics.

Examples of goods with reduced rate:

HS Code | Description of goods | Rate of Duty |

0307.11.20 00 | Fresh or chilled oysters | 5% |

0405.10.00 00 | Butter | 5% |

8525.89.10 00 | Video camera recorders | 5% |

9105.21.00 00 | Electrically operated wall clocks | 5% |

9603.10.20 00 | Brooms | 5% |

Specific Rate: Applies exclusively to a limited range of goods, specifically those related to petroleum like refined petroleum.

Example of goods:

HS Code | Description of goods | Rate of Duty |

2710.12.11 00 | Motor spirit, leaded: of RON 97 and above | RM0.60 per litre |

2711.11.00 00 | Liquefied Natural gas | RM0.01 per kg |

Sales Tax on Low-Value Goods (LVG)

This tax applies to all international goods sold on the online marketplace value below RM500, including those from duty-free islands and special areas like free zones.

This excludes:

Cigarettes

Tobacco products

Intoxicating liquors

Smoking pipes, including pipe bowls

E-cigarettes and similar vaping devices

E-cigarettes and vaping liquid or gel, whether it contains nicotine or not

A fixed rate of 10% will be applied to LVG at the point of purchase for online transactions. Commencing 1st January 2024, this tax was introduced to level the playing field between local and foreign goods.

Exemptions

Exempted Goods

Exempted goods are those that are not subject to the sales tax.

Some common examples are -

- Unprocessed daily food items like meat, fish, eggs, vegetables, fruits, spices, bread, and pasta;

- Pharmaceutical products such as chemicals or medications;

- Everyday essentials like batteries, books, and even gold jewellery.

These goods are listed in the Sales Tax (Goods Exempted from Sales Tax) Order 2022.

Examples of goods:

HS Code | Description of goods |

0704.10.10 00 | Cauliflowers |

1604.20.30 00 | Fishball |

1902.19.20 00 | Rice vermicelli (including bee hoon) |

9001.30.00 00 | Contact lenses |

9619.00.92 00 | Sanitary towels (pads) |

9506.99.30 00 | Shuttlecocks |

Exempted Persons

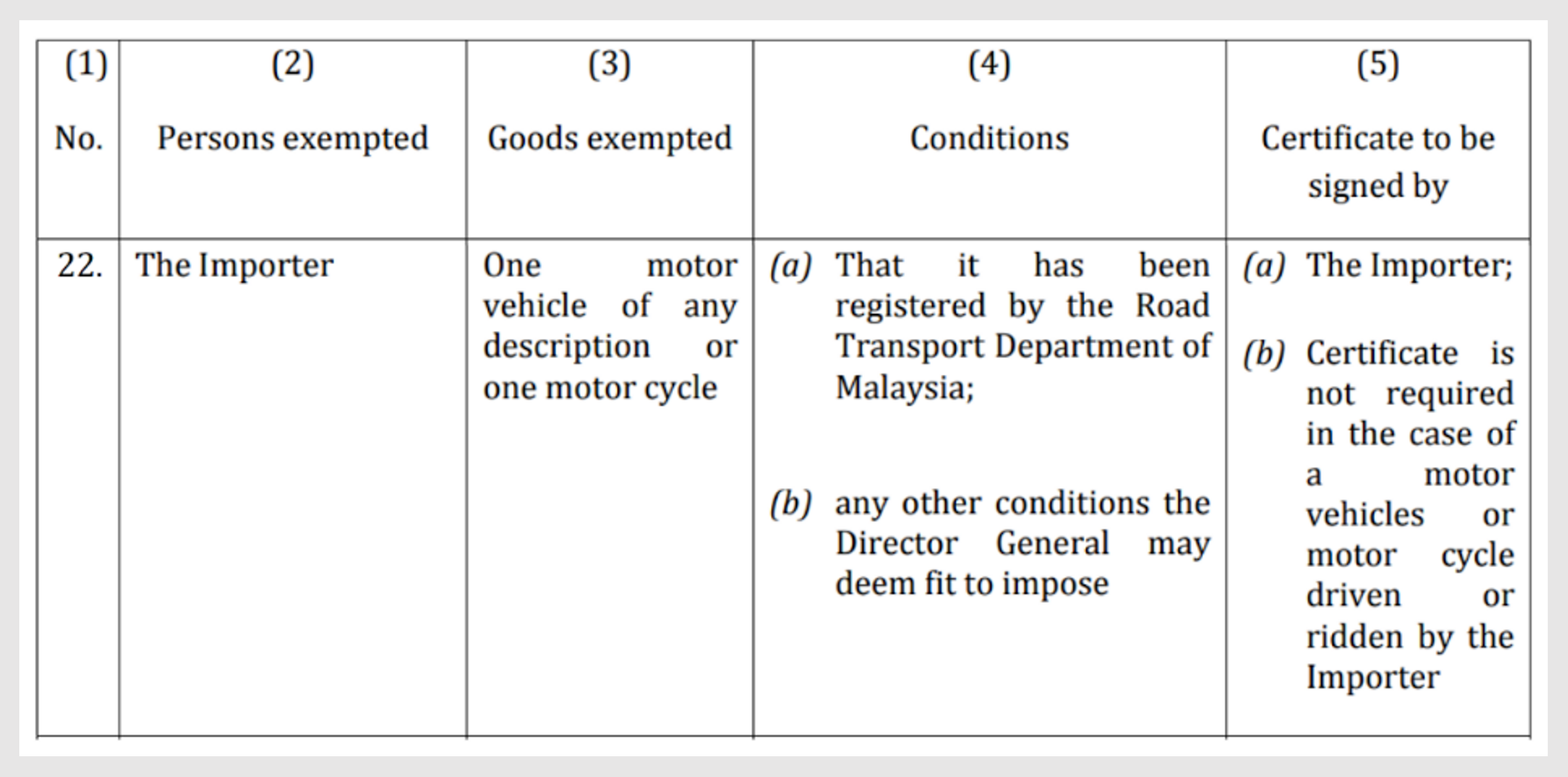

Certain individuals and goods are eligible for sales tax exemptions, all distinctly listed on Sales Tax (Persons Exempted From Payment of Tax) Order 2018. The list specifies both the eligible individuals and corresponding goods entitled to exemptions for each of them.

Here is a guide to navigate the table of exemptions:

2nd column: Individuals who are exempted from sales tax when importing the goods mentioned in the 3rd column

3rd column: Goods exempted from the sales tax

4th column: Conditions for goods or individuals to be eligible for the exemptions

5th column: The party obligated to present the certificate of eligibility

Calculation

To determine the sales tax on your imported goods, you need three key pieces of information:

- HS Code

- Import Duty

- Excise Duty

- Sales Tax Rate

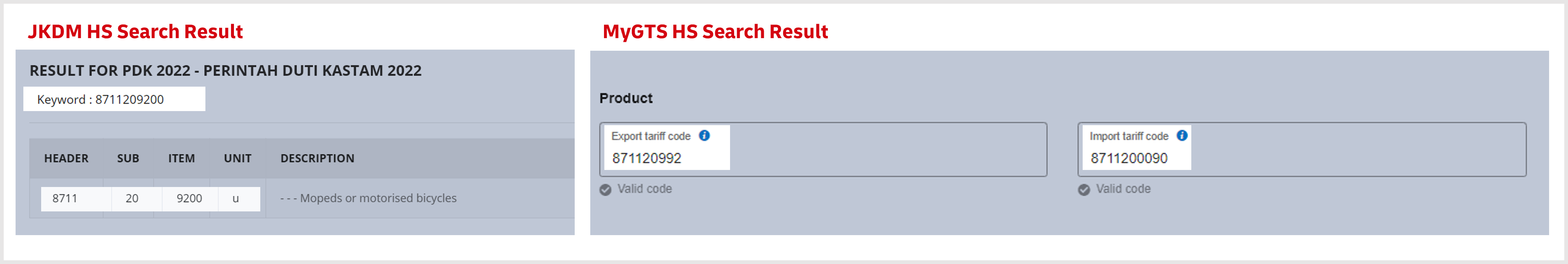

Step 1: Identify the HS Code

Get the right HS code.

Similar to import duty and excise duty, sales tax of goods can be determined using HS codes through Malaysian customs tariff searcher or DHL free HS search, MyGTS.

Step 2: Calculate Sales Tax

Sales tax can be determined by multiplying the sum of CIF value, import duty value, and excise duty value by the applicable sales tax rate.

The formula looks like this:

(CIF Value + Import Duty Value + Excise Duty Value) x Sales Tax Rate = Sales Tax Value

Hence, to get sales tax value, you first need to find out the goods' excise duty and import duty.

Take motorised bicycle as an example for this calculation -

Motorised Bicycle Details | HS Code: 8711209200 Import duty rate: 30% Excise duty rate: 20% CIF Value: RM5,000 |

Calculate Import Duty | RM5,000 x 30% = RM1,500 |

Calculate Excise Duty | (RM5,000 + RM1,500) x 20% = RM1,300 |

Calculate Sales Tax | (RM 5,000 + RM 1,500 + RM 1,300) × 10% = RM 780 |

Total Sales Tax Value | RM780 |

Payment

As sales tax for LVG is collected at the point of purchase, the following payment method pertains only to standard taxable goods.

After declaring it using the Customs Import Declaration Form No. 1 (K1 form), shippers must clear the assessed sales tax on the goods for them to be released from customs control.

There are 2 payment methods for sales tax:

1. Over the Counter (at Customs Import Offices)

Importers have the option to make payments directly at customs import offices.

2. Third-Party Appointed Platforms

Using third-party platforms for payment is another option. Service providers like ePayment, eDagangNet, and similar entities make sales tax payments secure and efficient.

However, in most cases, the payment process is facilitated by an appointed customs agent. Once the shipper provides all the necessary shipment documents, the agent can efficiently handle the payment on behalf of the importer.

Sales Tax Exemption Certificates are documents that exempt specific goods and manufacturing activities from sales tax.

To apply for an exemption certificate, you can use the MySST system. Once granted, this certificate or its number will serve as proof of exemption.

Sales tax is determined based on the value of goods.

Most goods are subject to the standard charge of 10%, only some essential goods are subject to 5% reduced rate.

To calculate sales tax, multiply the sum of CIF value, import duty value, and excise duty value by the sales tax rate.