INTERNATIONAL SHIPPING FAQS

Customs

-

Incoterms are a widely-used term of sale, which define the responsibilities of sellers and buyers. Incoterms specify who is responsible for paying for and managing the shipment, insurance, documentation, customs clearance, and other logistical activities.

At DHL eCommerce UK we offer two types of “Incoterms” (international commercial terms): “DDP” (Delivered Duty Paid) and “DAP” (Delivered at Place - also known as DDU, Delivered Duty Unpaid). They define the financial and procedural aspect of all international shipping practices and are essential in ensuring proper, timely payment of good and services.

-

IOSS is an online VAT registration system, enabling UK businesses to comply with the EU’s VAT obligations for goods sold to private EU customers with a value of up to €150.

Once your business is IOSS registered, VAT can be collected from buyers (your customers) at checkout and paid on EU sales by submitting a monthly EU VAT return.

IOSS applicable shipments:

- Ecommerce or marketplace seller

- Value of shipment is less than €150 (excluding shipping, insurance and taxes)

- Exclusions can apply, e.g. single use plastic cutlery

What about goods valued over €150?

If the total value of the parcel is more than €150, IOSS will not apply. Import taxes may be applicable to goods worth more than €150 and these will be payable at the time of clearance into the EU.

Is IOSS mandatory?

If you are an eCommerce trader with a typical basket value of less than €150, we highly recommend that your business register for IOSS. It will provide your customers with greater transparency regarding import taxes during the checkout process, while enabling you to experience faster clearance and transit times.

IOSS is not a mandatory requirement. If you decide against becoming IOSS registered, you can still choose to use our DDP and DAP services.

How do I register for IOSS?

To register for IOSS, you may choose to appoint an intermediary, who will perform the following actions on your behalf:

- Submit monthly IOSS VAT returns that contain the total value of the goods sold, their VAT rate and the total VAT amount to be paid, broken down by standard and reduced rate and for each EU country where you have sent goods.

- Make a monthly payment of any Local VAT due as declared in the IOSS VAT return.

If you sell through an online marketplace, they are likely to have registered for IOSS. You can enter the IOSS number of the marketplace in our shipping tool.

-

An Economic Operators Registration and Identification (EORI) number is needed by a business that is sending shipments to and from Europe. If you do not have a unique EORI number given to your business, you can apply for an EORI here: https://www.gov.uk/eori/applyforeori

- The EORI number will be stated on the customs declaration paperwork when sending parcels into Europe. When you have an account, we capture this as part of the booking process. The EORI number will be visible on your proforma or commercial invoice (the customs declaration paperwork).

- A shipper’s EORI number is required when exporting on all of our International services.

- When a shipment is going from a business (anywhere in the world) to a European customer (B2C), a recipient EORI is not mandatory

- When a shipment is going from a business (anywhere in the world) to another business that is based in Europe (B2B), a recipient EORI number is mandatory.

- When you set up an account, your dedicated Account Manager will request your EORI number and add it to your shipping account.

- The EORI number will be stated on the customs declaration paperwork when sending parcels into Europe. When you have an account, we capture this as part of the booking process. The EORI number will be visible on your proforma or commercial invoice (the customs declaration paperwork).

-

Tariff or commodity codes (also known as HS codes) are an International standardised system of numbers used to classify traded products.

The information is used by customs officials at customs clearance points across the world. Using a number to describe what is in the shipment means there is less confusion with vague descriptions and language barriers.

Customs use the commodity code, value of goods and origin of goods to calculate the duties to be paid so it’s important you fill in this information accurately.

To find the accurate commodity code for items inside of your shipment, visit: www.gov.uk/trade-tariff

-

You must provide a full and accurate description of each item inside your shipment. Poorly described shipments could be detained by customs or airline security for further examination and delay the delivery of your shipment.

- What it is e.g a pair of jeans

- What it is made from e.g denim

- What is it used for e.g wearing

When you set up a business account with DHL eCommerce UK, we capture this information as standard within the booking process.

- What it is e.g a pair of jeans

-

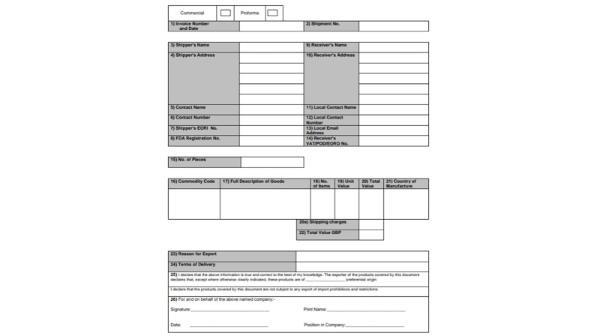

A proforma invoice is to be used for shipments that are being sent to the recipient free of charge. In other words, the reason for export would be ‘’Gift’’.

A commercial invoice is to be used for shipments that are being sold to the recipient. In other words, the reason for export would be ‘’Commercial Sale’’ or in some cases a ‘’Commercial Sample’’ if you are sending samples abroad.

Reason for export

- Gift = Proforma invoice

- Commercial Sale or Commercial Sample = Commercial invoice

At the time of sending a parcel using our shipping tool the correct invoice type will be provided once you select the reason for export.

-

If you send shipments through the DHL eCommerce UK network outside of the United Kingdom, you will need to supply Customs paperwork in the form of a proforma or commercial invoice in order to clear your shipment through Customs at its destination country. Customs paperwork/Invoices are not required for Northern Ireland.

Here is a list of what we will capture as part of the shipment booking process and what will be included on your Proforma or Commercial invoice:

- The reason for export; Commercial Sale, Gift or Commercial sample – The customs paperwork/invoice will then automatically state whether it is a “proforma invoice” or “commercial invoice”

- Your company name

- Your company address, including country

- Your contact name

- Your telephone number

- Your EORI (Economic Operator Registration and Identification) Number

- The EORI of your recipient if applicable (Read more here )

- The recipient’s name and the company name too if sending to a business

- The address and country of your recipient/business

- The local telephone number of the recipient/business

- The local email address of the recipient/business

- The registered VAT number of the business you are sending to – if applicable

- The Personal ID (PID) / Tax ID number of your recipient if sending to a country where this is mandatory. See a list of mandatory countries here.

- Number of parcels in the shipment

- Number of items in each shipment; each item must have an accurate commodity code (HS code) alongside a full and accurate description of each item – what it is, what it is made from, what it is used for.

- Country of manufacture of each item in your parcel – list separate countries, if applicable

- Unit value of each item inside each parcel

- The total shipping/freight fee you have charged your recipient

- Total of value of shipment plus the shipping/freight fee you have charged your recipient (our booking process will calculate this automatically) – before and after VAT

- Incoterms of shipment: DDP (Delivered Duty Paid) or DAP (Delivery at Place)

- IOSS number - if applicable

Once all your recipient and shipment data has been captured within the booking process, you will need to tick to agree/confirm the below to proceed with your booking:

- No items inside your shipments are prohibited or restricted. DHL eCommerce UK will not accept shipments that are subject to any export or import prohibitions and restrictions, unless agreed in writing prior to export.

With some of our international services you'll need to print & affix 5 copies of your proforma or commercial invoice to each shipment, each with an original signature.

- The reason for export; Commercial Sale, Gift or Commercial sample – The customs paperwork/invoice will then automatically state whether it is a “proforma invoice” or “commercial invoice”

-

When sending to a residential address some countries require you to supply the receiver’s personal, in-country, ID number to clear customs. The naming of this personal ID also varies by country.

Sending to a residential address within Europe:This is only applicable for shipments with a value of €150 or more.

- Cyprus – National ID number

- Estonia - Isikukood (Estonian ID)

- Finland - Social Security number

- Portugal - TAX ID / Personal ID

- Slovakia - Tax ID

- Slovenia - Personal No.

- Spain - Tax ID

Sending to a residential address, outside of Europe:

This is applicable for all shipments regardless of the parcel value

- Chile – Tax ID number

- Brazil – CPF number

- Argentina – Tax ID number

- South Africa – Tax ID number

- Saudi Arabia – Tax ID number

- South Korea – TIN (Tax ID number)

- Indonesia – Tax ID number

- China – Tax ID

- Taiwan – Tax ID

We capture this information as part of the booking process.

You will need to make sure you have this information from your recipient in advance before making your booking with DHL eCommerce UK.

- Cyprus – National ID number

Duties, taxes and payments

-

Duty is a tax on goods - imposed on imports and exports of goods. Read more about how to estimate duty costs here.

Tax is import VAT – is an in-country tax paid when receiving goods from abroad. Read more about how import VAT is calculated

Duties and taxes are imposed by countries to generate revenue, protect local industries against foreign competition, or both. The duties and taxes are usually paid before the goods are released from customs.

Duty and tax amounts are calculated off the individual items inside your shipment depending on:

- The items value

- Trade agreements

- Country of manufacture

- Use of items

- The items Tariff/Commodity/HS code

Customs officials assess duties and taxes, otherwise known as customs fees, based on information provided on the customs paperwork which is a proforma or commercial invoice.

You, as a DHL eCommerce UK customer are then charged any Duty (taxes on goods) and/or Tax (import VAT) on your payment invoice if sending on DDP terms.

See understanding your payment invoice - including any additional charges plus any taxes and duties for shipments for more information.

-

The amount of duty which is due is calculated by adding up the value of the goods, freight costs, insurance, and any additional costs. The total is then multiplied by the duty rate. This is the amount of duty which needs to be paid to customs for the shipment.

The duty rate for a particular item varies per country and are calculated based on three factors:

- Total value of the shipment

- Tariff codes / HS codes / Commodity codes

- Country of origin

For shipments to The European Union, the duty rate can be found at the following website:

https://ec.europa.eu/taxation_customs/dds2/taric/taric_consultation.jsp?Lang=enYou, as a DHL eCommerce UK customer are then charged any Duty (taxes on goods) and/or Tax (import VAT) on your payment invoice if sending on DDP terms OR, Your recipient will pay any Duty and/or Tax in-country if sending on DAP terms.

See Understanding your payment invoice - including any additional charges plus any taxes and duties for shipments for more information.

-

Import VAT is an in-country tax paid on goods purchased from overseas. It is applied to all distance sales into the EU and worldwide destinations. Import VAT is charged at the local rate of the country the shipment is being delivered to.

To calculate the import VAT rate, add up the value of the goods, freight costs, any insurance, any duty (if applicable) and multiply by the Import VAT rate. The import VAT rates differ across Europe. Please see below for the rates of import VAT across Europe.

- Austria: 20%

- Belgium: 21%

- Bulgaria: 20%

- Croatia: 25%

- Cyprus: 19%

- Czech: 21%

- Denmark: 25%

- Estonia: 20%

- Finland: 24%

- France: 20%

- Germany: 19%

- Greece: 24%

- Hungary: 27%

- Ireland: 23%

- Italy: 22%

- Latvia: 21%

- Lithuania: 21%

- Luxembourg: 17%

- Malta: 18%

- Netherlands: 21%

- Norway: 25%

- Poland: 23%

- Portugal: 23%

- Romania: 19%

- Slovakia: 20%

- Slovenia: 22%

- Spain: 21%

You, as a DHL eCommerce UK customer, are charged any Import VAT (in-country tax) on your payment invoice if sending on DDP terms OR, Your recipient will pay any Import VAT (in-country tax) if sending on DDU/DAP terms.

See Understanding your payment invoice - including any additional charges plus any taxes and duties for shipments for more information.

-

Delivered Duty Paid (DDP)

Under the DDP incoterm rules, the seller is responsible for all costs for delivering the goods to the named destination. The seller must pay both export and import formalities, fees, duties, and taxes. DHL eCommerce UK or their representative will pay the import charges upfront to customs then charge this back to your DHL eCommerce UK business account plus an admin fee. See ‘Understanding your payment invoice - including any additional charges plus any taxes and duties for shipments" for more information.

Delivered Duty Unpaid/Delivered at Place

Under DAP incoterm rules, the recipient of the parcel pays any applicable import fees, duties and taxes. The seller pays all freight charges. The recipient is sent a payment link to make duties and taxes payments or maybe contacted via phone for payment.

Both of our European and Global ecommerce services are available on DDP and DAP terms.

See Understanding your payment invoice - including any additional charges plus any taxes and duties for shipments for more information.

-

The frequency and day you receive your payment invoice will be agreed when you set up an account with DHL eCommerce UK. Payment invoices are usually emailed to you on a weekly basis and will contain the following information.

- Your businesses DHL eCommerce UK account number

- Date of invoice

- Invoice number

- Your registered business (trading) address

- Your registered billing (invoice) address

- Email address to which all account queries should be sent to

- For each shipment sent within the invoice period agreed, there will be separate lines detailing:

- Date shipment is collected/dropped off

- Number of parcels inside each shipment

- Shipment tracking number

- Recipient/your customer reference for each shipment

- Any VAT applicable to shipment

- Shipment description

- Shipment delivery address

- Contents value of shipment - For the invoice period agreed, there will be:

- Total value of all shipments sent – before and after VAT

- VAT summary

- Amount Due

For shipments sent on DDP terms: You will receive a separate taxes and duties invoice in addition to your normal payment invoice (as detailed above). Please note that taxes and duties invoices are usually sent a few weeks after your scheduled payment invoice, but in some cases, it can take up to 6 months. Your DDP taxes and duties invoice will also include the admin fees incurred and any import VAT (taxes) if applicable.

DDP admin charges that may apply:

- DHL Parcel Connect £5

- EU Road Economy £13

These charges will only apply where either import duties or taxes are payable at the time of import clearance into the EU.

Restrictions

-

There are a number of goods that are not suitable to be sent across our service for both UK and International deliveries – as well as country-specific items that are not permitted into some overseas destinations. It’s very important that you check these lists of DHL restricted and prohibited items to ensure your parcel is delivered without cancellation, delay, seizure or return to you; as the sender, you are responsible for making sure only allowed items are sent through our network.

It's our policy not to carry any dangerous goods, prohibited or restricted items or valuable items.

Anything considered hazardous, such as acids, chemicals and other corrosive substances, as well as prohibited articles that can pose a hazard to health and safety are dangerous goods. This also includes items that could cause damage to property or the environment in the event of a leak or spillage. Any items specified in the United Nations Recommendations on the Transport of Dangerous Goods are prohibited.

Items not permitted by international or national law, rule or regulations are prohibited or restricted goods. These include firearms, weapons, explosives and munitions (including replicas and imitations), as well as animals and animal parts, livestock, insects, and tobacco products. Any items that the carriage of could break laws or rules in any country the consignment may travel are prohibited.

Any goods of a high value are valuable goods. This includes bullion, cashier or traveller’s cheques, currency, credit or debit cards, passports, antiques, precious stones and more. Some jewellery, designer items and artworks are also restricted dependant on their value.

These lists are not exhaustive; they exist as a rough guide only. Please check our terms and conditions or get in touch with us for more accuracy.

It is your responsibility to ensure that your items do not contain anything which could be termed as prohibited or unsuitable for carriage. All items listed below (or any item similar in description or content) cannot be carried under any circumstances by us. Any person sending such items will have their order cancelled without notice or refund.

We will not compensate for any items deemed as dangerous, prohibited, restricted, valuable or breakable.

Any cover provided by us (either standard or extended contents cover) will be invalidated, and if your parcel causes damage to the parcels of other senders, we will recover the costs of repairing such damage from you.

No refund(s) will be given for any loss or damage on these items – including any standard cover provided by us or any additional cover taken out and paid for by yourself.

All items are technically breakable however, there are some that are much more fragile to transport than others. "Breakable goods" include glass, china, ceramics, pottery, stoneware, fossils, works of art and televisions whose screen size exceeds 37 inches, items which are made from, or consist of rock (whether igneous, metamorphic, sedimentary or otherwise).

Prohibited items:

- Animals / animal parts / livestock and insects

- Antiques - Infectious substances

- Artwork and works of art

- Biological samples

- Car body panels / bumpers / car seats / air bags / batteries / windows

- Credit / debit cards

- Currency / gift vouchers / cashiers or travellers cheques / money orders / negotiable instruments in bearer form / bullion

- Dangerous goods

- Designer goods (including handbags / footwear / clothing / watches / jewellery)

- Drugs (including prescription drugs)

- Dumbbell and gym weight plates

- Fire extinguishers

- Firearms including replicas and imitations

- Foodstuffs

- Goods over our maximum dimension limits

- Hazardous goods and Radioactive material

- Human remains

- Important and legal documents – including but not limited to passports, tenders, share option certificates, identification, medical, travel, land registry or home ownership documentation.

- Infectious substances

- Inks & Toners

- Lighter fluid and matches

- Liquids (in any form including alcohol and liquid cosmetics etc)

- Lithium-ion Batteries

- Living organisms / body parts

- Medicines (including over the counter)

- Paint

- Perishable goods

- Plants

- Precious metals and stones (i.e. Gold, Silver, Diamonds etc.)

- Stamps

- Tobacco or tobacco products

- Unprotected Furniture (assembled i.e. sofas / wardrobes / tables)

- Weapons / explosives / munitions (including but not limited to replicas, imitations and blank firing pistols)

- White goods (fridges / freezers, washing machines etc.)

Items Unsuitable for Carriage:

- Ceramics (including pottery / china / stoneware / marble / concrete etc.)

- Fossils

- Glass (including mirrors / light bulbs / glass screens)

- Items which are made from, or consist of rock (whether igneous, metamorphic, sedimentary or otherwise)

- Paper items

- Televisions or other electronic graphical display equipment with screen size exceeding 37 inches

- Works of art (or similar materials)

- Animals / animal parts / livestock and insects

-

The following countries are currently sanctioned:

- Belarus

- Cuba

- Iran

- Korea North

- Russia

- Syria

- Ukraine

-

The maximum weight and dimensions for our international ecommerce services are:

Connect IOSS/Connect Non-IOSS

200 x 120 x 80 cm (l x w x h) and up to 31kgConnect Worldwide

200 x 200 x 120 cm (l x w x h) and up to 40kgParcels dropped off at or delivered to a ServicePoint for any of the services above:

60 x 60 x 60 cm (l x w x h) and up to 15kgIf you would like your recipient to have the ability to re-arrange their parcel delivery to their nearest ServicePoint or locker in country (click here to see the list of countries this service is available on) please note that weight and dimension restrictions apply.

General

-

Book and pay for your parcel delivery at https://send.dhlparcel.co.uk, which is perfect for ad-hoc senders or an alternative to the post office. You can have your parcel collected from your door or save when you drop off at a ServicePoint or Depot. You even get 10% off your first order* (terms apply). International services are currently unavailable, but you can still send parcels within the UK.

-

That’s great! Simply request a call back here.

You can start accessing excellent International parcel delivery rates, dedicated account managers and best in class technology to manage the dispatch and delivery of your parcels within just 24 hours*.

A dedicated sales advisor will be in touch to discuss your requirements and to give you a personalised parcel delivery rate. Simply request a call back here.

-

We have a dedicated business customer support hub here where you can access a wealth of information offering help and support. You’ll find frequently asked questions on parcel delivery, useful guides and much more. There is also a short video, which will guide you through some of the information you'll receive when you start trading as a business customer with DHL eCommerce UK.

-

No, you do not but you must have a registered businesses address to set up a business account with DHL eCommerce UK. Alternatively, if you are a business sending out of a residential address you can use our personal sender’s website here.

-

If you ship large volumes, we understand that working with a number of delivery partners gives you more flexibility and choice, whilst using a third party shipping tool allows you to manage your deliveries. We can integrate with some of the largest third party shipping tools, including Metapack, Linnworks, Shiptheory and Scurri.

-

You can integrate seamlessly with our best in-class technology to manage the dispatch, progress and delivery of all your shipments. The DHL eCommerce UK APIs are a set of tools and services that enable our customers and partners to integrate directly with DHL eCommerce UKs latest products to ensure they are simple to access and easy to use.

We have a dedicated integrations team who will assist with this and your dedicated account manager will be on hand to support you through the entire process.

Access to the DHL Developer portal is freely available and can be used to test all the API end points with the suite of test accounts available on the portal.

-

No problem, if you complete the enquiry form here, one of our dedicated international sales advisors will be in touch to discuss your requirements.

-

Your parcels will be handled at many stages throughout its journey and may pass through fully automated sorters and conveyor systems so it’s important you package your parcels correctly to avoid any damages during transit.

As the sender, it’s your responsibility to make sure your parcels are addressed and labelled correctly, adequately packaged inside and out and that the items being shipped are not prohibited or restricted.

-

Our dedicated international sales advisors will be able to contact you directly to discuss your requirements if they fall outside of our ‘standard’ service offering. Just fill in this short form we’ll be in touch.

-

That’s no problem! The DHL Express services are perfect for urgent and time sensitive parcels that simply need to be delivered to a certain country within a tight deadline.

You can get a quote and book DHL Express services https://parcel.dhl.co.uk/

Tracking

-

You can track all international parcels here. Simply enter your tracking number and you will be able to see the status of your parcel at each stage it has been scanned.