The United Kingdom left the European Union on January 31, 2020. From 01.01.2021 , new EU trade rules with the UK, including customs clearance and VAT, come into effect. They do not apply to Northern Ireland.

WE SUPPORT YOUR BUSINESS IN NEW CONDITIONS

DHL eCommerce provides customs clearance under DAP (DDU) rules - delivered, duty unpaid

DHL PARCEL CONNECT - SHIPMENTS TO THE UK

No DHL Parcel Return Connect and DHL Parcel Return International

SHIPMENT AND DELIVERY

ADDITIONAL SERVICES

CONDITIONS FOR CUSTOMS CLEARANCE

The Incoterms define the distribution of transport costs, responsibilities and risks between the sender and receiver of a parcel.

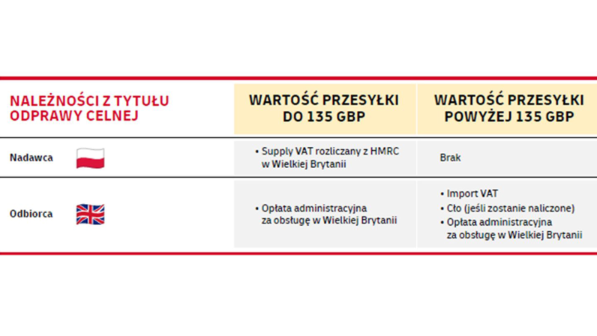

ADDITIONAL PAYMENTS FOR CUSTOMS CLEARANCE

Surcharge for simplified clearance

- Up to a maximum value of goods of EUR 1,000.

- It is not possible to receive a confirmation of export entitling to apply 0% VAT rate on exports.

- Requires CN23 declaration and proforma invoice to be prepared independently in the DHL tool. Printed customs documents should be attached in 2 copies.

Surcharge for individual clearance

- Up to the maximum value of the goods PLN 100,000.

- It gives the possibility of receiving a confirmation of export, entitling to apply 0% VAT rate on exports.

- It requires DHL eCommerce to verify in the Netherlands on the basis of a completed customer onboarding form, grant DHL eCommerce a power of attorney to act as a direct representative to make customs declarations and attach an electronic commercial invoice to the shipment.

Surcharge for each customs tariff code above 5 (not applicable to shipments with simplified clearance)

The customs tariff code is a series of numbers assigned to a given category of goods. On its basis, the product is identified and the appropriate payment is collected at check-in. If the number of customs tariff codes in the shipment exceeds 5, a surcharge will be charged for each additional customs tariff code.

Ask your sales representative for the details of the DHL offer.

CUSTOMS CLEARANCE - WE WILL CARRY IT OUT FOR YOU

The choice of the procedure depends on the value of your goods and whether you want to recover VAT

Do you want to apply for VAT return?

WHAT DO YOU NEED FOR SHIPPING?

EORI - Economic Operators' Registration and Identification, Community System for Registration and Identification of Economic Entities. It is part of the electronic customs system. How to get an EORI number - check HERE

VAT REGISTRATION NUMBER - is a British tax identification number (the equivalent of the Polish NIP), necessary to pay VAT. or shipmentsworth less than £ 135, the EU seller will have to pay VAT in Great Britain (so-called Supply VAT), and for shipments with a value of more than £ 135 - the so-called VAT import. How to get a VAT REGISTRATION NUMBER - check HERE

CUSTOMS DATA AND DOCUMENTS REQUIRED

MISSING DOCUMENTS OR INCORRECT DATA MAY CAUSE DELAYS IN DELIVERY (EXTENDED CHECK-IN TIME) OR RETURN THE SHIPMENT TO THE SENDER!